🤔 Collatz Conjecture, The Y-Intercept & Intangibles

22 August 2021

Welcome back to the Week That Was series highlighting things from the interwebs which are interesting, noteworthy and/or probably worth your time.

Articles📝, Tweet(s)📱, Videos🎥, Charts 📈 all fair game with or without attendant commentary.

🎨⭕ Lin Yung Cheng

Untitled, Lin Yung Cheng, photography, 2021

From 📝WeAndTheColor:

Lin Yung Cheng aka ‘3cm’ is a photographer and art director who lives and works in Taiwan. The creative mind loves to experiment with optical illusions and whimsical compositions to create images that draw the viewer into their spell

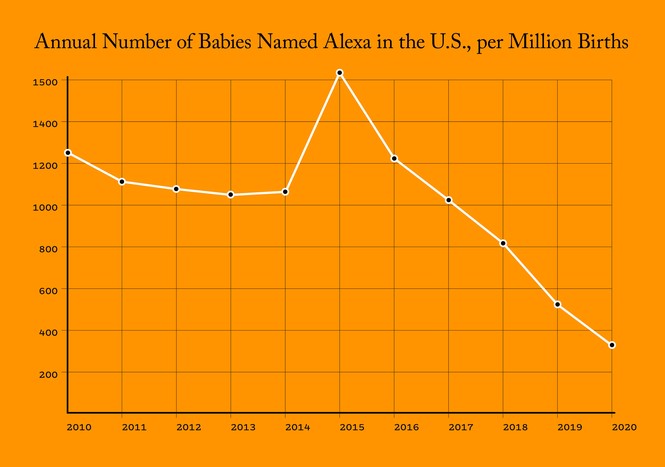

🍼📉 Alexa - “Please cancel this name”

Amazon killed the name Alexa.

From 📰The Atlantic:

Parents are fleeing from a name that can be, at best, a nuisance and, at worst, associated with subservience. Alexa used to be a name primarily given to human babies. Now it’s mainly for robots.

📈 Optimise for Slope, not Y-Intercept

From 📝Matt Rickard:

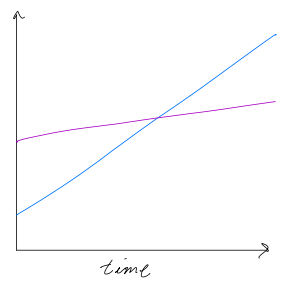

Forget about the y-intercept; slope is the only thing that matters in the long run.

Imagine your life as a line. On the x-axis, time. On the y-axis, think of a goal you’re trying to achieve: whether a personal one like getting in shape or a professional one like getting that promotion.

Two variables describe every line: the y-intercept, where the line crosses the y-axis, and the slope, or how fast it changes over time.

If y-intercept is what you start with, then slope is how quickly you adapt, learn, and the effort you put in.

Even if one line starts well below the other, it will end up on top as long as it has a larger slope."

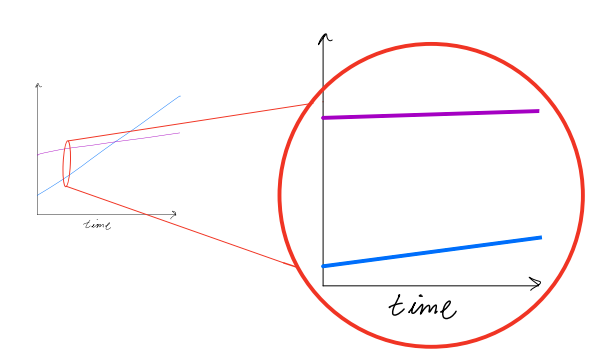

The short run is always longer than we think, but the long run is always shorter than we think

In a nutshell:

On ideas, don’t give up when things aren’t living up to your standards — every great idea started with a spark.

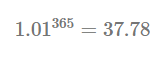

On learning a new skill, improve a little every day. Continuous improvements add up over time.

On motivation, use the right time scale. Everything looks flat over a small enough interval.

On starting in last place, know that slope always beats y-intercept in the long run.

Murat Demirbas recently had a similarly themed post called 📝“Progress beats perfect”

This is a favorite saying of mine. I use it to motivate myself when I feel disheartened about how much I have to learn and improve. If I do a little every day or every week, I will get there. If I get one percent better each day for one year, I’ll end up thirty-seven times better by the end of the year.

🤖📹 Tesla AI Day

As easy as it is to be snarky about yet another outlandish-sounding promise coming from Elon Musk about a humanoid AI-powered robot by next year (see 📝elonsbrokenpromises.com re skepticism) - there were a number of pretty incredible announcements discussed at quite a deep level of technical detail during the Tesla AI Day presentation.

Lex Fridman is a pretty great bet for a quick rundown of the highlights.

Outline:

- 0:00 - Overview

- 1:16 - Neural network architecture

- 4:55 - Data and annotation

- 6:44 - Autopilot & DOJO

- 8:28 - Summary: 3 key ideas

- 9:55 - Tesla Bot

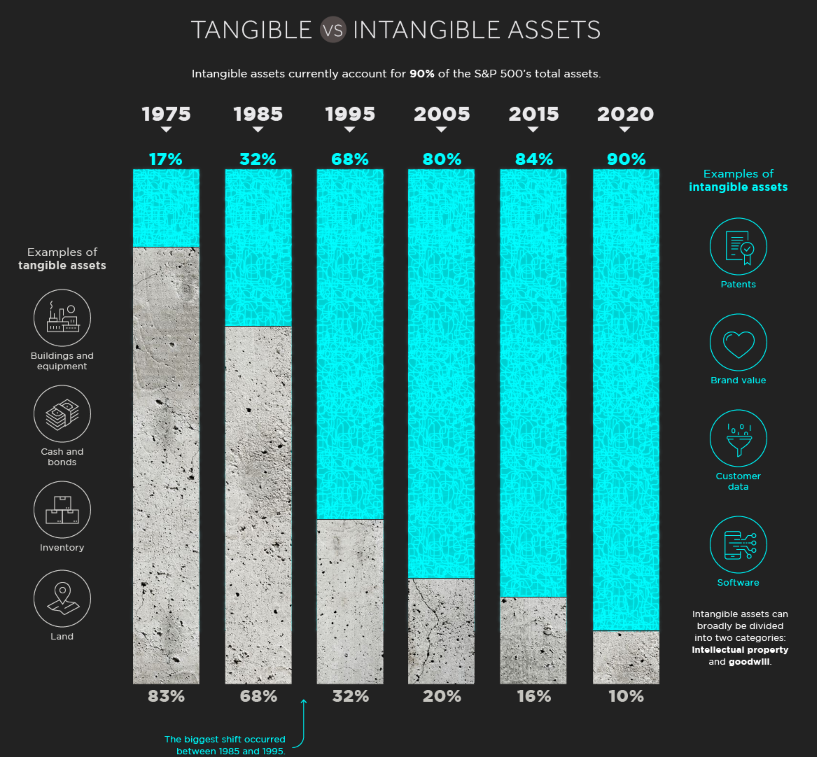

⚗️ Tangible v Intangible

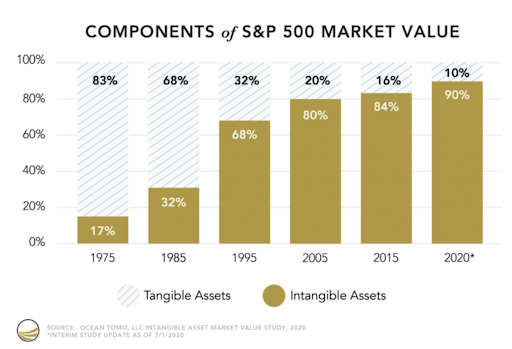

Per 📝Jeff Dorman:

As silly as NFTs sound to some, it’s worth noting that the rise in scarce, bearer, digital assets isn’t too different from what we’ve seen in traditional markets for the past two decades. The majority of growth in the equity market has come from companies that sell services, and own intangible assets versus those that own tangible assets. As Joe Weisenthal of Bloomberg pointed out recently, “Between Bitcoin, NFTs, trading cards, sneakers as an asset class and so on… there’s just a general bull market in bearer assets of all sorts.”

Markets are shifting away from owning physical property, and moving towards digital property and digital services.

📝Rickus Carsten also notes:

Per (Visual Capitalist, Nov 2020), it’s hard to underestimate the impact of Technology on Human interaction, companies and even S&P 500 entities…a +73% shift towards Intangible assets (vs Tangible assets) over the last 5 decades…

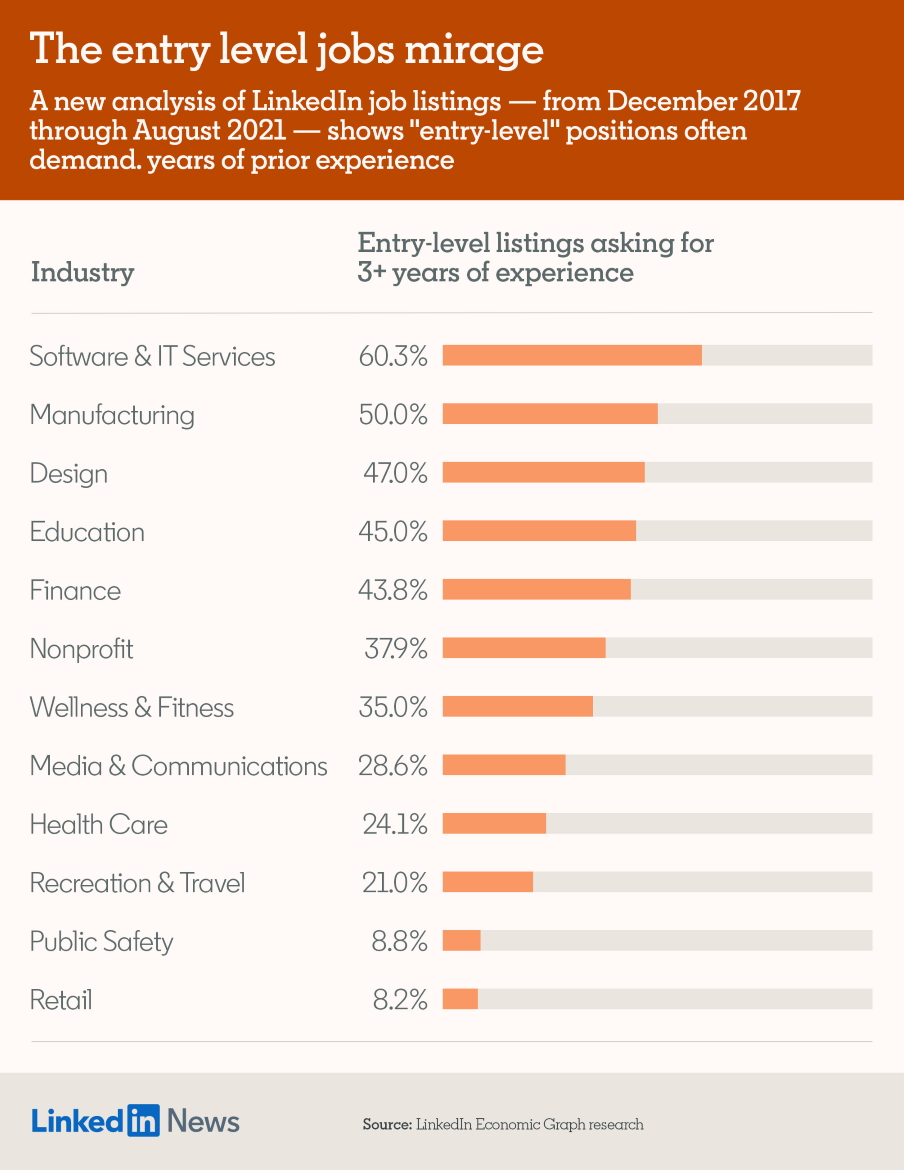

💼 LinkedIn “Entry Level”

35% of “entry-level” jobs on LinkedIn require 3+ years of experience

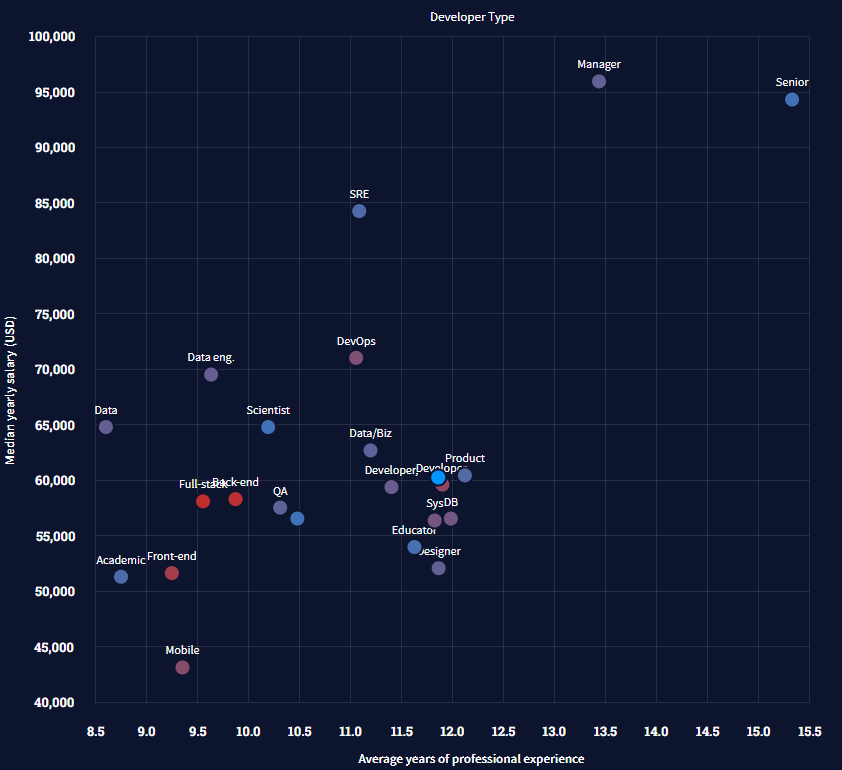

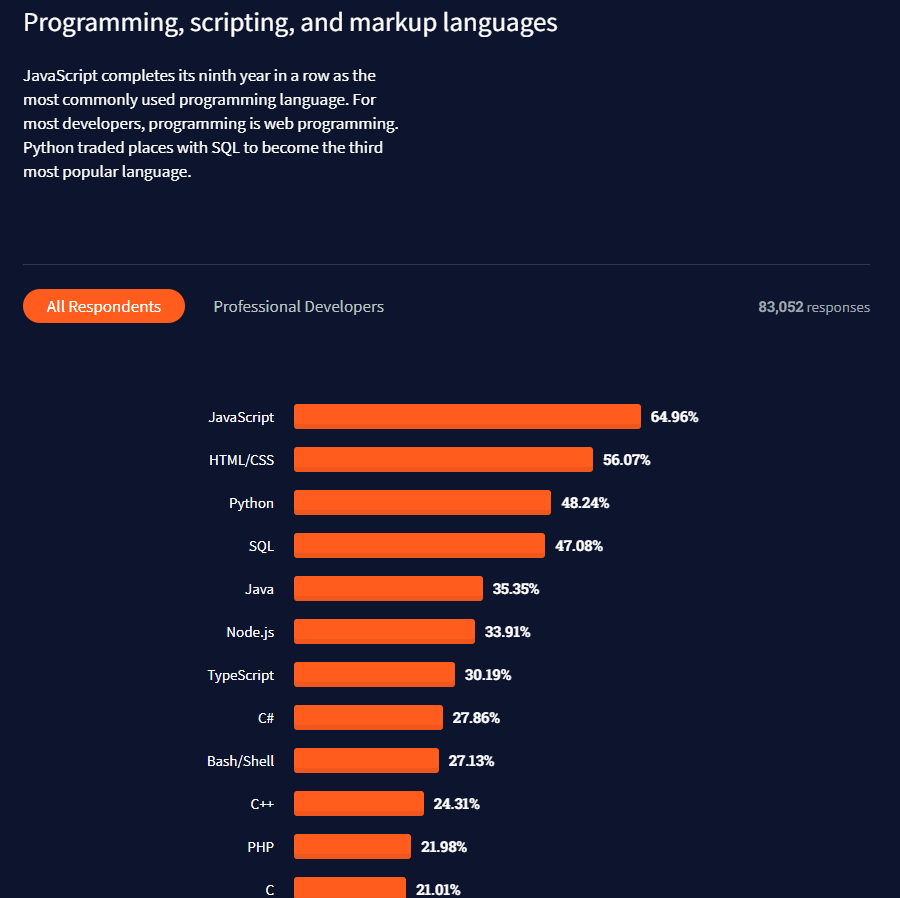

📊 Developer Survey

In May 2021 over 📚80,000 developers told StackOverFlow how they learn and level up, which tools they’re using, and what they want.

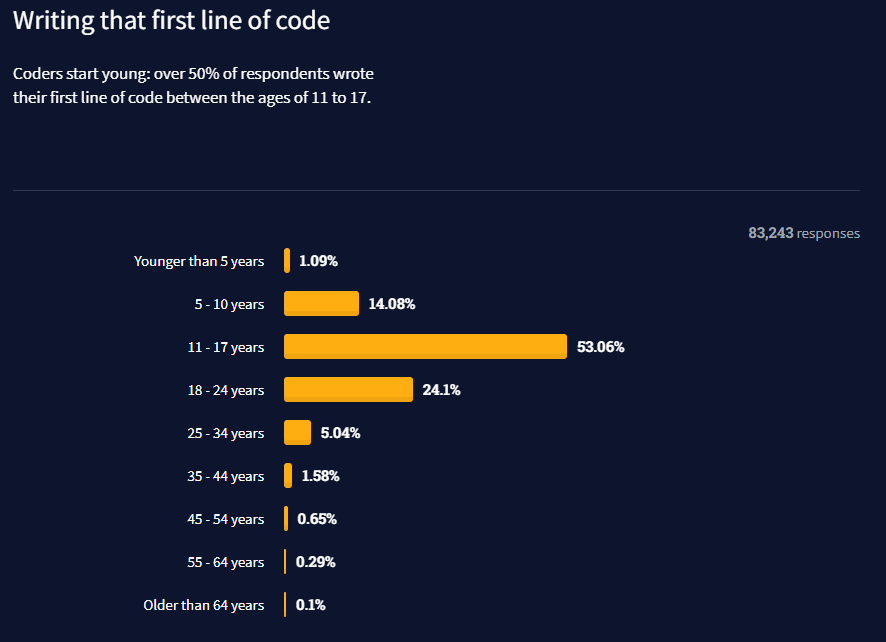

This year they observed a significant evolution in the way developers educate themselves. For the rising cohort of coders under the age of 18, online resources like videos and blogs are more popular than books and school combined, a statistic that doesn’t hold for any of our other age cohorts.

Overall, the profession is full of new joiners, with more than 50% indicating they have been coding for less than a decade, and more than 35% having less than five years in the trade.

Salaries & Experience

Most Popular Languages

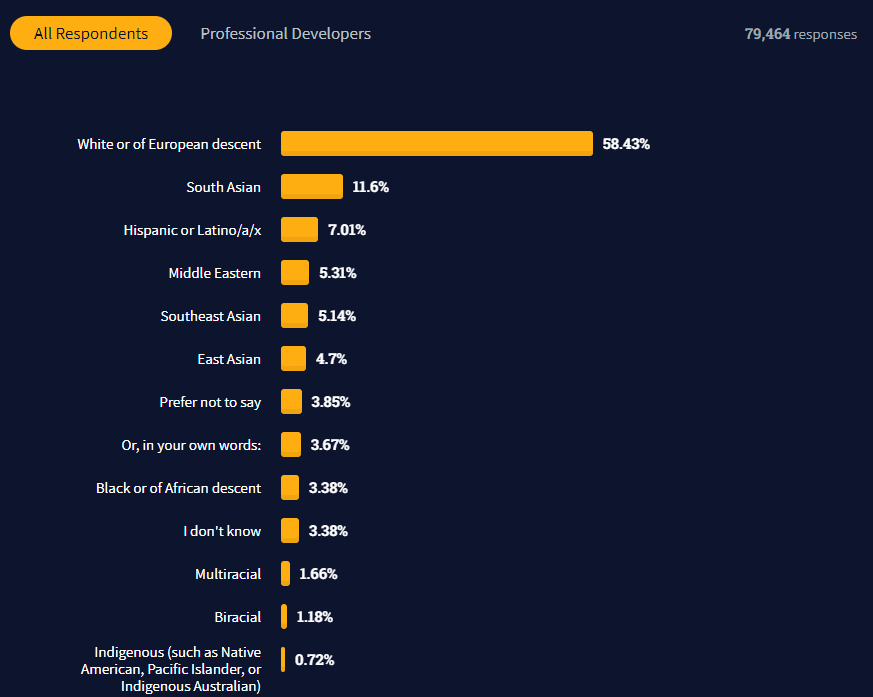

Race & Ethnicity

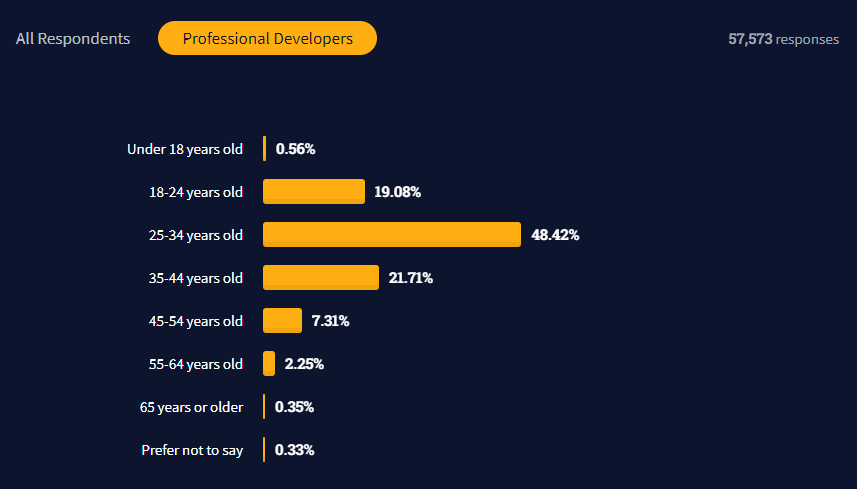

Age:Pros

First Line of Code

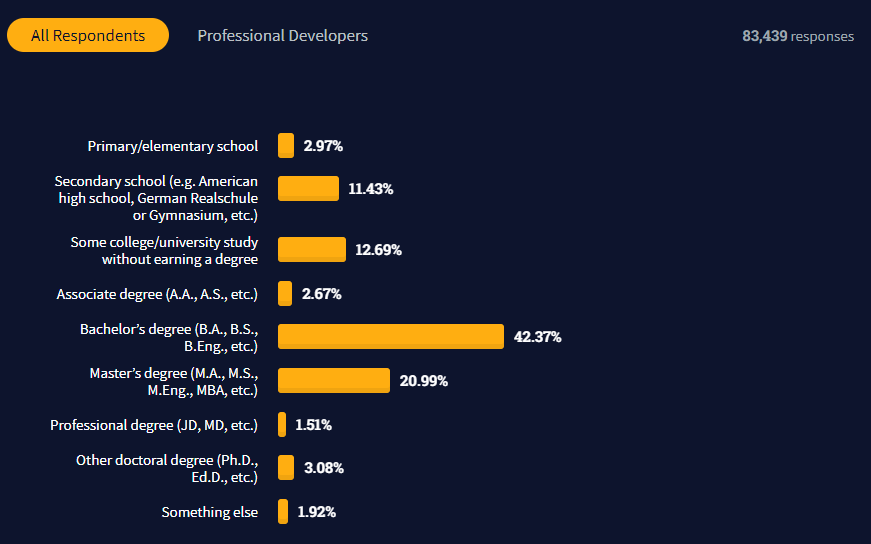

Qualifications

🌍 The Humanity Globe

New dataviz: The Humanity Globe. Population density across the world, visualized in 3D with #rayrender (using #RStats and #rayshader to process the data).

— Tyler Morgan-Wall (tylermorganwall at fosstodon) (@tylermorganwall) August 17, 2021

Code:https://t.co/lW0JrOgvk3

Rayrender:https://t.co/iB5nWhpnfN#dataviz #DataVisualization pic.twitter.com/kgnPLrz0iU

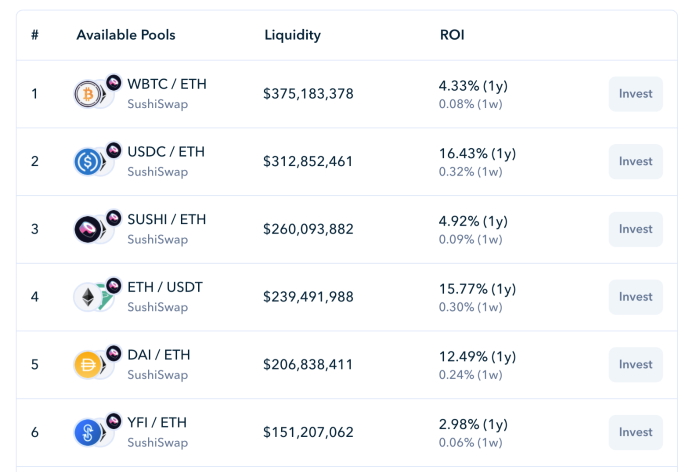

💸 DeFi - 150% APR?

From Nat Eliason:

Savings accounts in the TradFi world pay 0.35% if you’re lucky (in the US/Europe). So how is the APR on everything in DeFi around 3 - 7% minimum, and often into the tens, hundreds, or thousands of percent?

It’s easy to see those rates and say “that’s a scam” or “that’s too good to be true,” and you’d be right sometimes. But some of this yield can be explained without using the word ponzi. And in this piece, I’m going to try to explain where it’s coming from, and what yields are robust, vs what yields are closer to unstable ponzi schemes.

There are four types of yield that make up the foundation of all robust earnings in DeFi:

- Staking Rewards: compensation for helping secure the blockchain

- Lending Rates: interest earned for providing funds other people can borrow

- Exchange Rewards: fees earned for helped decentralized exchanges fill trades

- Fee Distributions: fees charged by platforms that are distributed to their token holders

Read the rest here:

📝150% APR? How Are DeFi Yields So High?

🔢🤔 Collatz Conjecture

The Collatz Conjecture is the simplest math problem no one can solve — it is easy enough for almost anyone to understand but notoriously difficult to solve

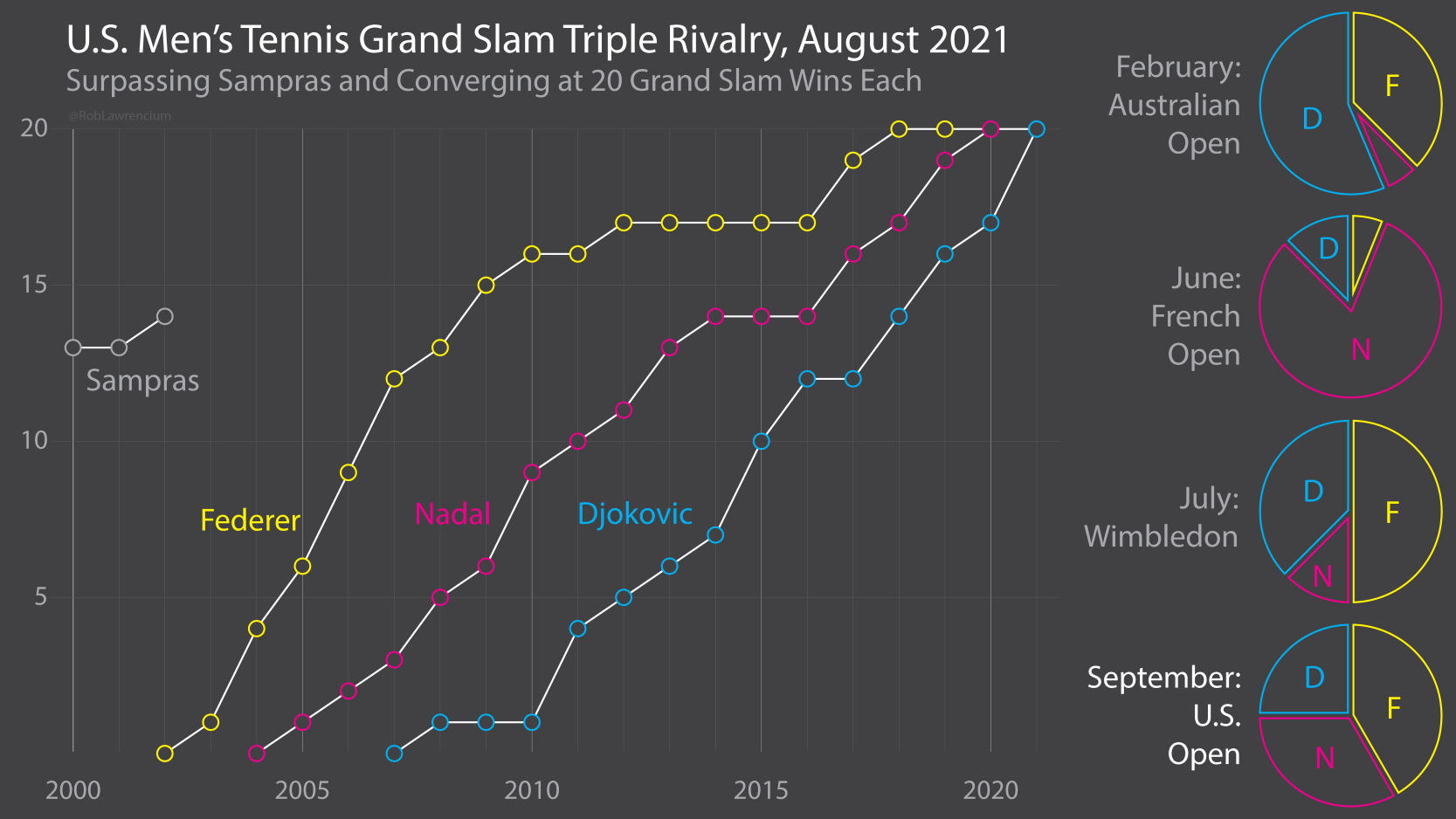

🎾 Grand Slams

U.S. Men’s Tennis Grand Slam Wins: The Convergence of Federer, Nadal, and Djokovic.

These three have won an incredible 60 titles, and everyone else has won 14.

🏦 The Giant Pool of Money

A decade and a half later, this TAL look at the people affected by the infamous housing crisis is still as compelling, touching and informative as ever. It was also an award winning episode.

A special program about the housing crisis produced in a special collaboration with NPR News. We explain it all to you. What does the housing crisis have to do with the turmoil on Wall Street? Why did banks make half-million dollar loans to people without jobs or income? And why is everyone talking so much about the 1930s?

🎨 Summer at Bondi

Summer at Bondi, Sally West, oil on canvas, 2021

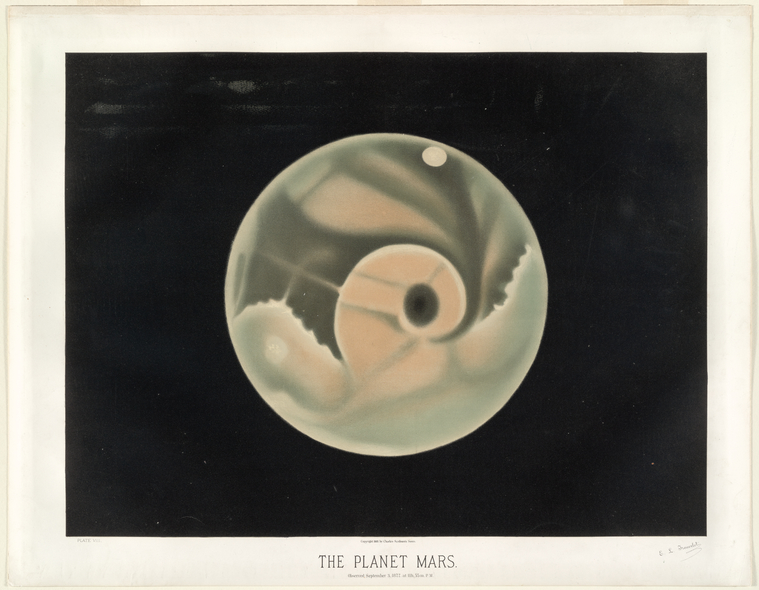

🪐🔭 1800s v NASA

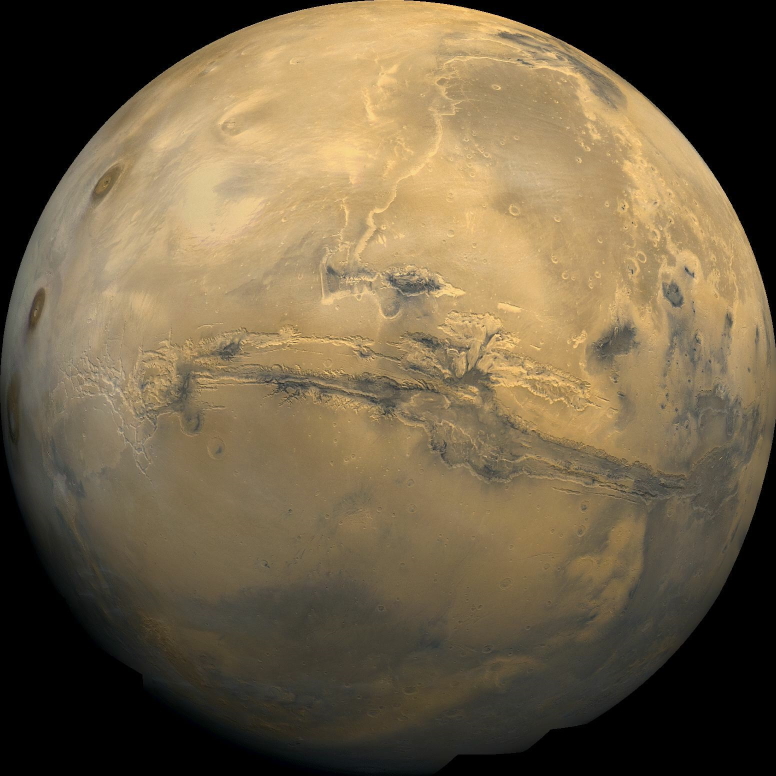

A few E. L. Trouvelot astronomical pastel drawings taken from Lauren Weiss’s 2016 post compared to modern NASA astrophotography.

The full set - taken from New York Public Library’s Digital Collections trove is available here.

Mars

1877

2017

Jupiter

1880

2017

Orion Nebula

1876

2017

Partial Eclipse of the Moon

1874

2017

💬 Deep Cuts

“Life without industry is guilt. Industry without art is brutality” — John Ruskin

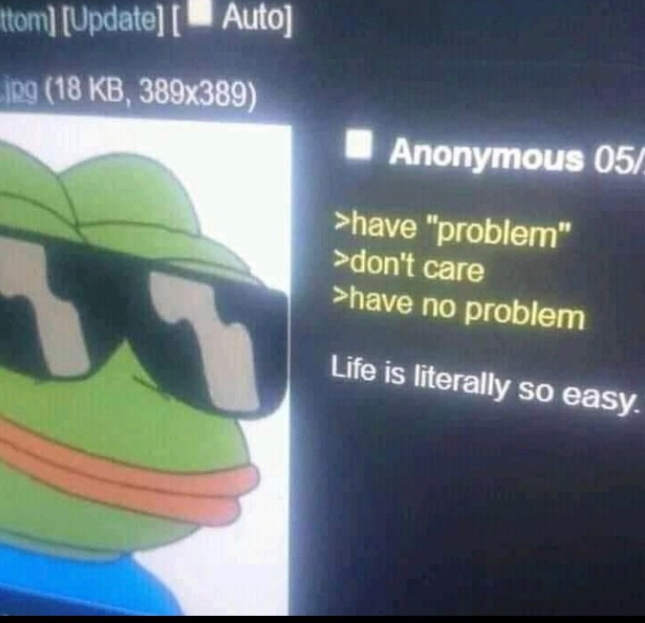

“If you are distressed by anything external, the pain is not due to the thing itself, but to your estimate of it; and this you have the power to revoke at any moment.” — Marcus Aurelius

Marcus Aurelius, 2021:

🎨 One More Thing

The Long Way Home, Digital, 2021

📧 Get this weekly in your mailbox

Thanks for reading. Tune in next week. And please share with your network.

Links The Week That Was Pickings

fa17eab @ 2023-09-18