🧲🧊 Meissner, Gell-Mann & Productivity

30 July 2023

After a pretty lengthy break, welcome back to the Week That Was series highlighting things from the interwebs which are interesting, noteworthy and/or probably worth your time.

Articles📝, Tweet(s)📱, Videos🎥, Charts 📈 all fair game with or without attendant commentary.

🎨 Productivity

Productivity, Blue Fury, Digital, 2022

📰🧠 Gell-Mann Amnesia

There are two times in a man’s life when he should not speculate: when he can’t afford it and when he can. — Mark Twain

From Robert Cottrell:

Michael Crichton wonders why newspapers spend so much time speculating uselessly about the future, and wonders if this weakness might be related to the Gell-Mann Amnesia Effect: “Even though the speculation is correct only by chance, which means you are wrong at least 50% of the time, nobody remembers and therefore nobody cares. You are never accountable”

What is Gell-Mann Amnesia? I encountered the concept a few years ago and have seen it everywhere ever since while reading journalist coverage of subjects which I’ve very well read in or areas within my professional purview.

To wit:

Briefly stated, the Gell-Mann Amnesia effect is as follows. You open the newspaper to an article on some subject you know well. In Murray’s case, physics. In mine, show business. You read the article and see the journalist has absolutely no understanding of either the facts or the issues. Often, the article is so wrong it actually presents the story backward—reversing cause and effect. I call these the “wet streets cause rain” stories. Paper’s full of them.

In any case, you read with exasperation or amusement the multiple errors in a story, and then turn the page to national or international affairs, and read as if the rest of the newspaper was somehow more accurate about Palestine than the baloney you just read. You turn the page, and forget what you know.

In the piece called 📝WHY SPECULATE?, he goes onto link the effect to this idea of unaccountable speculation which is endemic in the punditry classes - from football to economics:

That is the Gell-Mann Amnesia effect. I’d point out it does not operate in other arenas of life. In ordinary life, if somebody consistently exaggerates or lies to you, you soon discount everything they say. In court, there is the legal doctrine of falsus in uno, falsus in omnibus, which means untruthful in one part, untruthful in all. But when it comes to the media, we believe against evidence that it is probably worth our time to read other parts of the paper. When, in fact, it almost certainly isn’t. The only possible explanation for our behavior is amnesia.

So one problem with speculation is that it piggybacks on the Gell-Mann effect of unwarranted credibility, making the speculation look more useful than it is.

Addendum: 📝Forecasting: The Dismal Art

🧲🧊📚 We’re Back. It’s Over

So if you’ve traipsed through social media, have an interest in materials science or are in any particularly enlightening groupchats you’ve undoubtedly come across the buzz around LK99 - the purported room-temperature superconductor at the heart of 📚a new and controversial paper published by Sukbae Lee, Ji-Hoon Kim and Young-Wan Kwon.

The abstract opens with:

For the first time in the world, we succeeded in synthesizing the room-temperature superconductor (Tc≥400 K, 127∘C) working at ambient pressure with a modified lead-apatite (LK-99) structure. The superconductivity of LK-99 is proved with the Critical temperature (Tc), Zero-resistivity, Critical current (Ic), Critical magnetic field (Hc), and the Meissner effect.

📹

Meissner effect

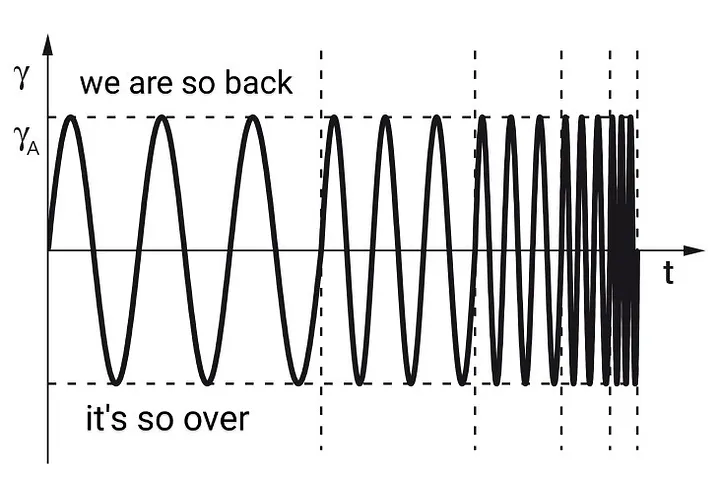

Given the history of spurious claims in this space, it’s been greeted with the requisite skepticism - if only to temper the giddy excitement on the other end of the spectrum. I think this graphic accurately represents online narratives over the last few days on the topic:

Credit: Elsa Zhou

Credit: Elsa Zhou

Each revelation of what’s turning into quite a drama regarding the publishing team (blow by blow coverage in excrutiating detail being provided by the likes of @8teAPi) is fascinating to say the least.

The papers were not ready for publication.

— Ate-a-Pi (@8teAPi) July 27, 2023

Lee & Kim had been working on the material on and off since Kim was in graduate school in 1999 (LK-99 geddit?). Lee never makes tenure and is still stuck as an adjunct professor 19 years later. Kim goes off to work in battery materials… https://t.co/gGRoaL3n3C

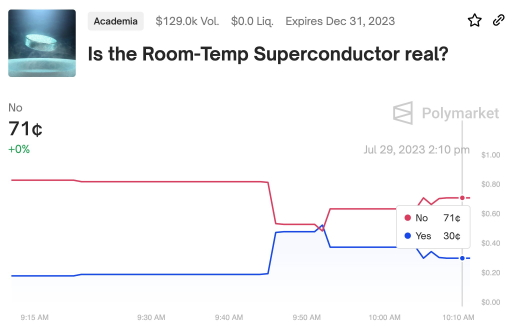

Action on betting markets has also been quite erratic, although an unreliable indicator given how extremely thin the liquidity is on the likes of Polymarket and Manifold for this.

Why the excitement? A quick (3 min) primer on superconductivity

Brief explainer of superconductivity, and why a room temperature one would be a HUGE deal 👇 #LK99 pic.twitter.com/HyGVtvodSO

— Liv Boeree (@Liv_Boeree) July 29, 2023

I think it’s safe to say a room-temperature superconductor would represent an enormous step change in our technological capability e.g.:

Energy Transmission - Would enable lossless transmission of electricity over long distances, representing huge efficiency gains to power grids

Power Generation - A revolution in the efficiency and performance of generators and turbines in power plants, making them more compact and powerful.

Energy Storage - The development of highly efficient energy storage systems, enabling large-scale and long-term storage of renewable energy.

Magnetic Levitation - Due to the powerful magnetic fields they can create, it would enable efficient and frictionless levitation, which could revolutionize transportation systems such as high-speed trains and maglev vehicles.

Medical Applications - Superconductors could be utilized in advanced medical imaging technologies like MRI machines, enhancing their performance and reducing energy consumption.

Electronics - Room temperature superconductors could lead to the development of faster and more energy-efficient electronic devices.

Quantum computing - Room temperature superconductors could be used to create more powerful and efficient quantum computers. leading to advances in fields such as AI, cryptography, and materials science (nice recursion) and more

However it’s important to exercise extreme caution here as noted, given the paper was published as a pre-print on arXiv, still needs to undergo peer-review and have it’s results replicated.

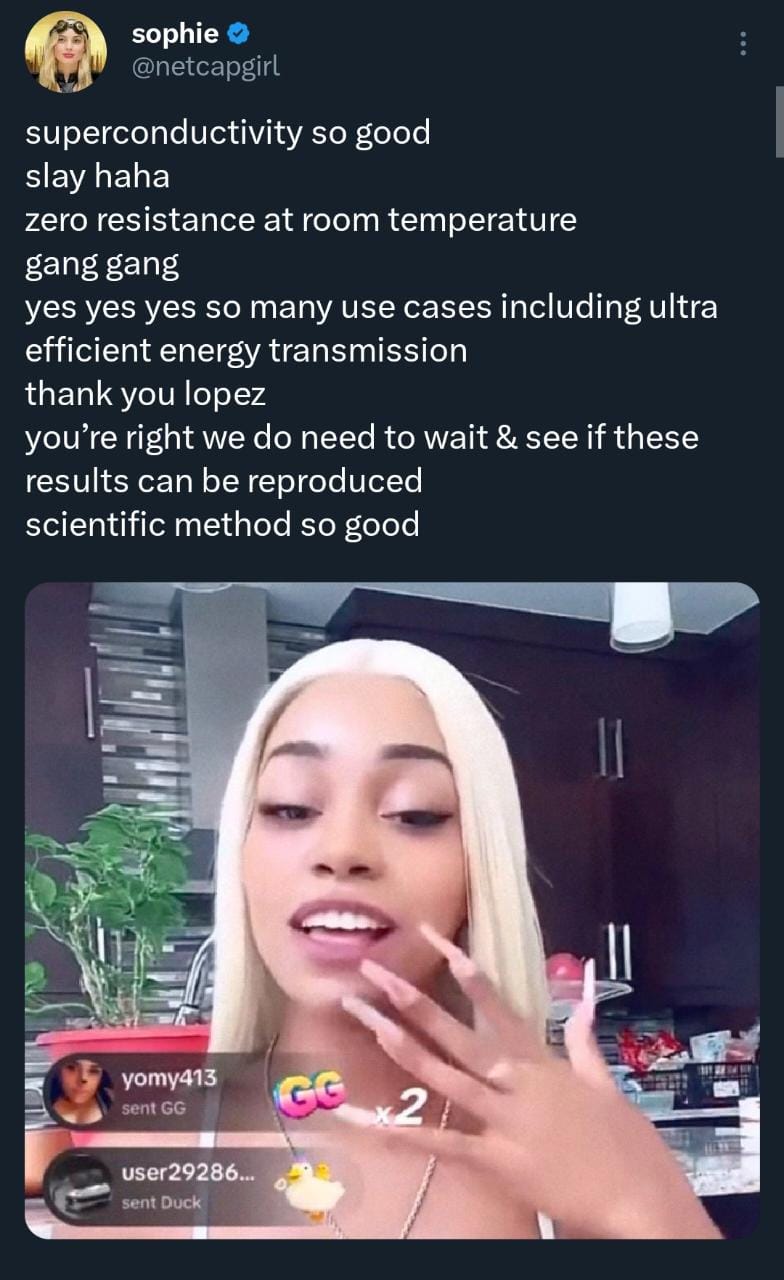

All of this has really been to give you enough context to explain this meme to be honest 😂

Scientific Method So Good! So now we wait.

🎨 Otso

Otso, Josh Dykgraaf, Digital, 2023

From the artist:

This image is a photo-composite of burnt pine forests and images of preventative back-burning that I’ve shot over the years, manipulated into the form of a family of bears.

The narrative layers speak for themselves.

🤖🧠 Dept. of Machine Intelligence

Reid Hoffman joined Tyler to talk everything AI: the optimal liability regime for LLMs, whether there’ll be autonomous money-making bots, which agency should regulate AI, how AI will affect the media ecosystem and the communication of ideas, what percentage of the American population will eschew it, how gaming will evolve, whether AI’s future will be open-source or proprietary, the binding constraint preventing the next big step in AI, which philosopher has risen in importance thanks to AI, what he’d ask a dolphin, what LLMs have taught him about friendship, how higher education will change, and more. They also discuss Sam Altman’s overlooked skill, the biggest cultural problem in America, the most underrated tech scene, and what he’ll do next.

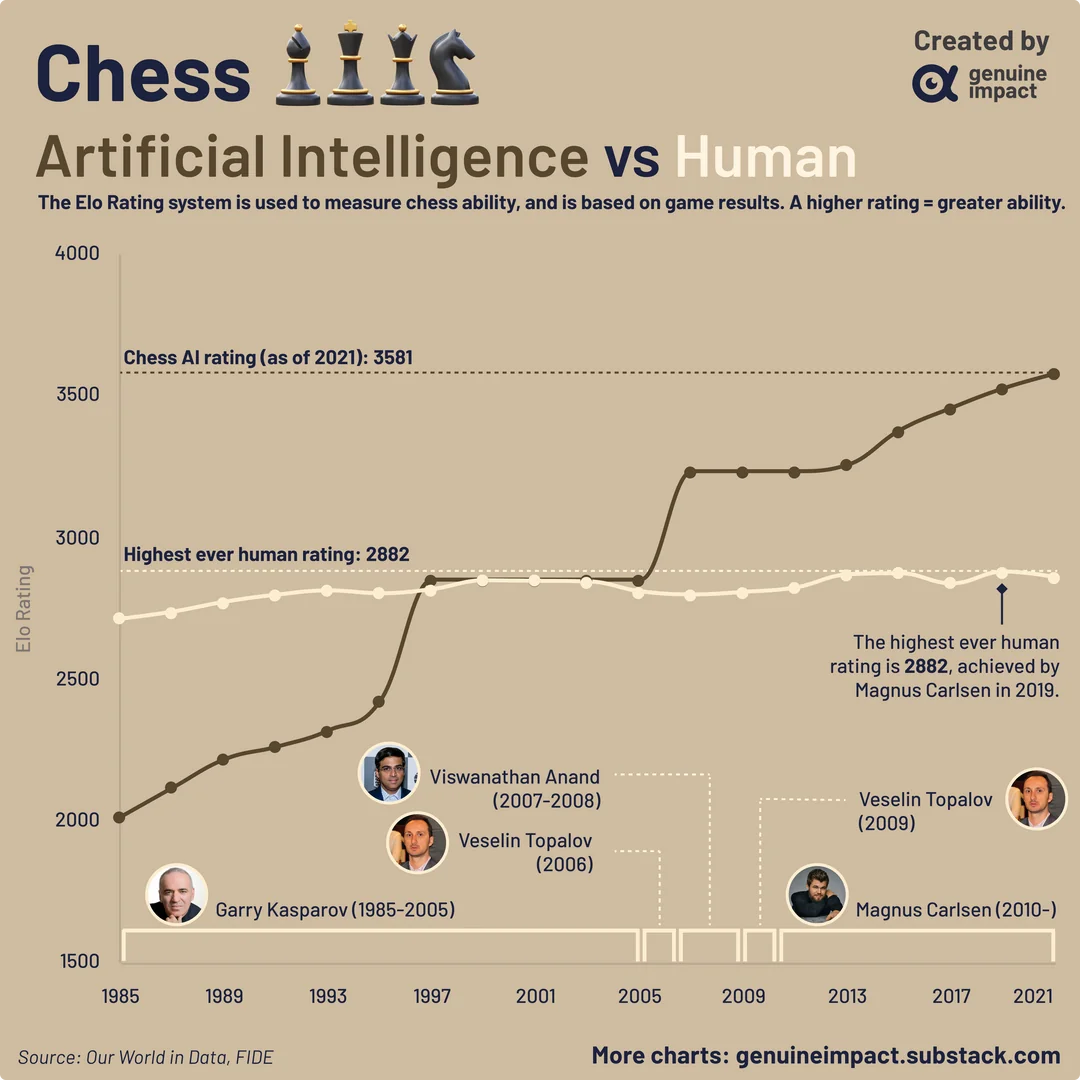

Chart showing the ELO rating between the top-rated human player since 1985 versus that of the strongest chess engine / AI. Brown line is the computer. White line is the humans.

ELO in this case just being a probabilistic guess at the result of a match between two rated players. A 400 gap maps to approximately 10-1 odds of the higher ELO player winning any particular match.

📚

Great resource from the A16Z team where they’ve shared a curated list of resources they’ve relied on to get smarter about modern AI. They call it the “AI Canon” because these papers, blog posts, courses, and guides have had an outsized impact on the field over the past several years.

📉

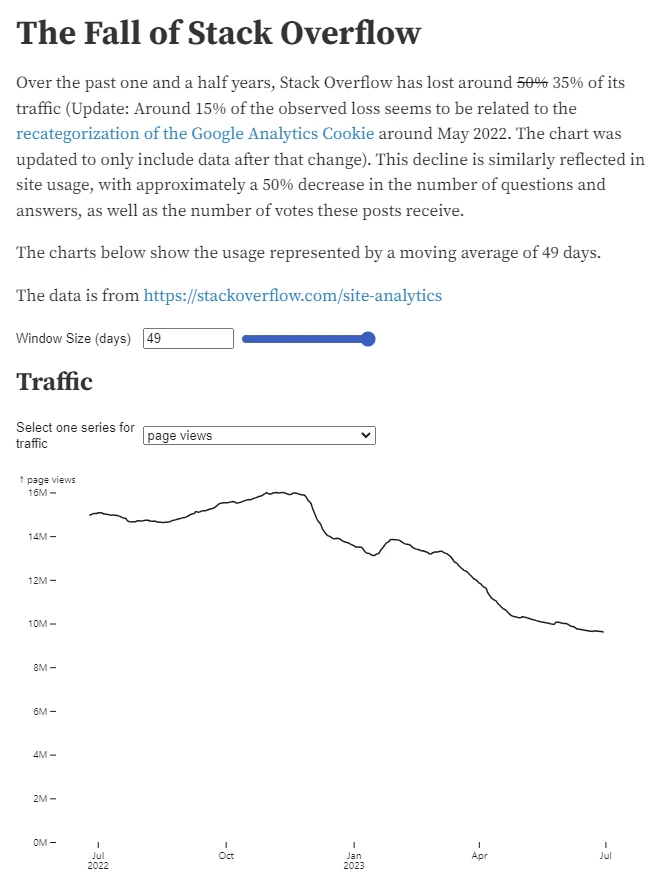

Also. Interesting to see how much traffic has come down on dev-help lookup site StackOverFlow in the last yar and a half. Ayhan Fuat Çelik has been 📝monitoring this here - and I think it’s hard not to impute AI impact here.

Stack Overflow brass don’t seem to be asleep at the wheel though - they announced OverflowAI a few days ago.

🔑🎮 The Password Game

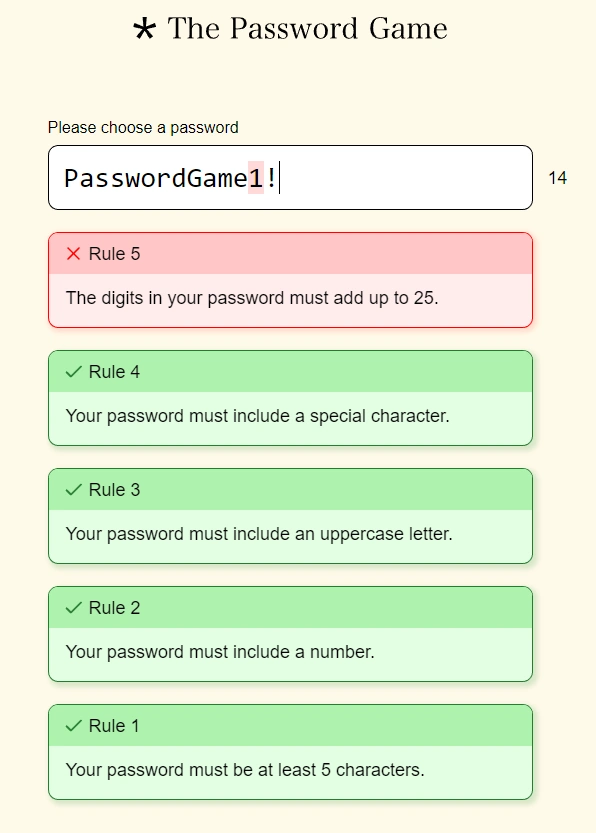

Last week was an LLM-driven password jailbreaking game.

This week it’s also passwords but even more frustrating (possibly masochistic?)…and addictive for a certain personality type.

📺💸 Oppie & Barbara

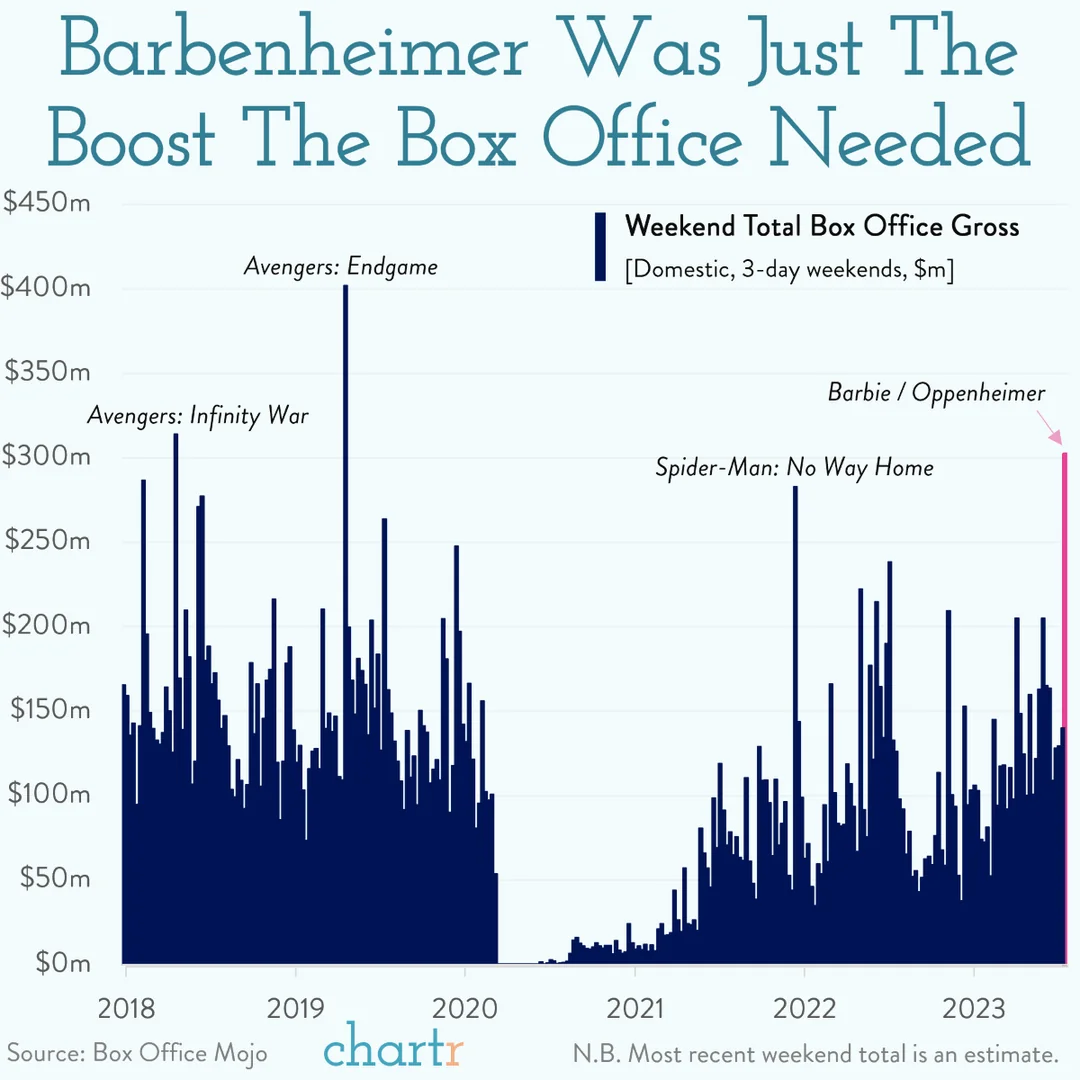

Per last week, the wombo-combo of Oppenheimer and Barbie delivered box office proceeds in spades. A real cultural phenom which drove the largest opening weekend since Avengers Endgame concluded a 10 year saga.

The second weekend dropoff is also incredibly low for both films given how big they opened (usually anything close to 50% down for a blockbuster is considered very good - with most averaging between 55%-70% down).

Both Barbenheimer movies had historically low second weekend drops:

— DiscussingFilm (@DiscussingFilm) July 30, 2023

• ‘BARBIE’ - $93M (42.3%)

• ‘OPPENHEIMER’ - $46.2M (44%) pic.twitter.com/RLQqE14l7Z

Oppenheimer will also be holding onto it’s IMAX screens for a week longer (sorry Tom Cruise)

I enjoyed both (Greta Gerwig is amazing) but was smitten with Oppenheimer. I’ve just started reading the tome upon which Nolan based the film.

📹

🐂📜 Oxen Parable

In 1906, the great statistician Francis Galton observed a competition to guess the weight of an ox at a country fair. Eight hundred people entered. Galton, being the kind of man he was, ran statistical tests on the numbers. He discovered that the average guess (1,197lb) was extremely close to the actual weight (1,198lb) of the ox. This story was told by James Surowiecki, in his entertaining book The Wisdom of Crowds.

Not many people know the events that followed. A few years later, the scales seemed to become less and less reliable. Repairs were expensive; but the fair organiser had a brilliant idea. Since attendees were so good at guessing the weight of an ox, it was unnecessary to repair the scales. The organiser would simply ask everyone to guess the weight, and take the average of their estimates.

A new problem emerged, however. Once weight-guessing competitions became the rage, some participants tried to cheat. They even sought privileged information from the farmer who had bred the ox. It was feared that if some people had an edge, others would be reluctant to enter the weight-guessing competition. With only a few entrants, you could not rely on the wisdom of the crowd. The process of weight discovery would be damaged.

Strict regulatory rules were introduced. The farmer was asked to prepare three monthly bulletins on the development of his ox. These bulletins were posted on the door of the market for everyone to read. If the farmer gave his friends any other information about the beast, that was also to be posted on the market door. Anyone who entered the competition with knowledge concerning the ox that was not available to the world at large would be expelled from the market. In this way, the integrity of the weight-guessing process would be maintained.

Professional analysts scrutinised the contents of these regulatory announcements and advised their clients on their implications. They wined and dined farmers; once the farmers were required to be careful about the information they disclosed, however, these lunches became less fruitful.

Some brighter analysts realised that understanding the nutrition and health of the ox was not that useful anyway. What mattered were the guesses of the bystanders. Since the beast was no longer being weighed, the key to success lay not in correctly assessing its weight, but rather in correctly assessing what other people would guess. Or what others would guess others would guess. And so on.

Some, such as old Farmer Buffett, claimed that the results of this process were more and more divorced from the realities of ox-rearing. He was ignored, however. True, Farmer Buffett’s beasts did appear healthy and well fed, and his finances were ever more prosperous: but, it was agreed, he was a simple countryman who did not really understand how markets work.

International bodies were established to define the rules for assessing the weight of the ox. There were two competing standards – generally accepted ox-weighing principles and international ox-weighing standards. However, both agreed on one fundamental principle, which followed from the need to eliminate the role of subjective assessment by any individual. The weight of the ox was officially defined as the average of everyone’s guesses.

One difficulty was that sometimes there were few, or even no, guesses of the oxen’s weight. But that problem was soon overcome. Mathematicians from the University of Chicago developed models from which it was possible to estimate what, if there had actually been many guesses as to the weight of the animal, the average of these guesses would have been. No knowledge of animal husbandry was required, only a powerful computer.

By this time, there was a large industry of professional weight guessers, organisers of weight- guessing competitions and advisers helping people to refine their guesses. Some people suggested that it might be cheaper to repair the scales, but they were derided: why go back to relying on the judgment of a single auctioneer when you could benefit from the aggregated wisdom of so many clever people?

And then the ox died. Among all this activity, no one had remembered to feed it.

🎨 Good Sleep

Finally some good sleep. Caleb Worcester, Digital, 2023

💬 Deep Cuts

“For every complex problem there is an answer that is clear, simple, and wrong” ― H. L. Mencken

🗾🎹 One more thing

Some 80s era synthscapes for a bit of levity to round out this week’s iteration

📧 Get this weekly in your mailbox

Thanks for reading. Tune in next week. And please share with your network.

Links The Week That Was Pickings

fa17eab @ 2023-09-18