(This Week) Carrington, Vaccines & Permanent Assumptions

14 June 2020

Welcome back to the Week That Was series where I highlight a few things from the interwebs which I thought were interesting, noteworthy and probably worth your time.

Articles📝, Tweet(s)📱, Videos🎥, Charts 📈 all fair game with or without attendant commentary.

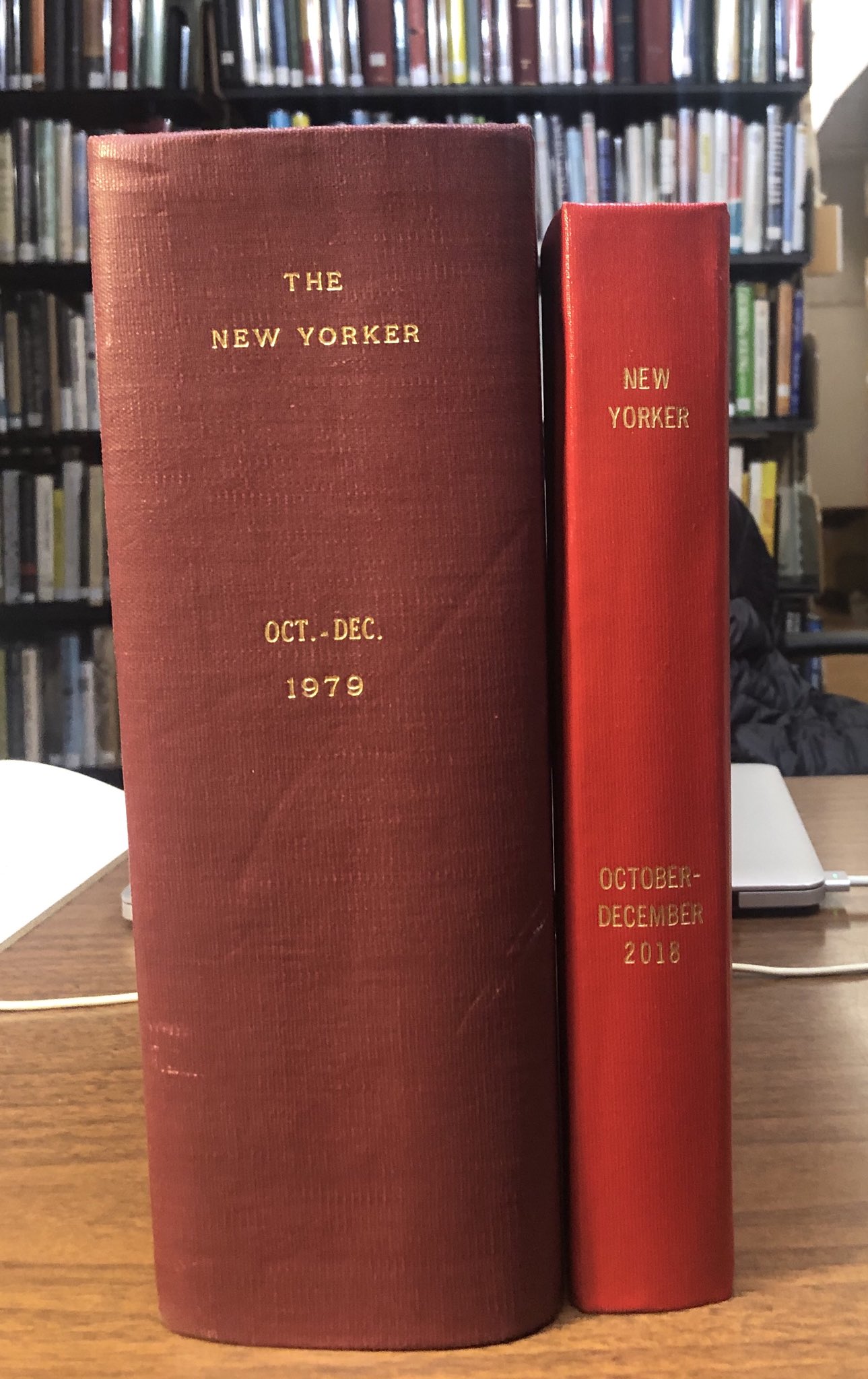

📚📰 Print Publishing

The history of magazine publishing in one photo.

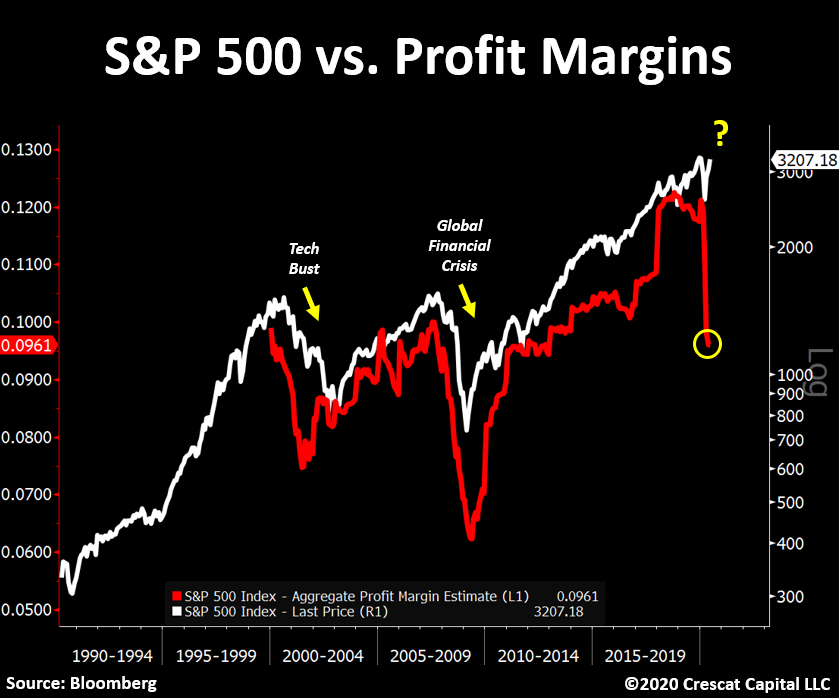

📊📉📈🙃 Maakehts

Expect the unexpected.

For some who bought Sasol shares in March at the low ZAR20s mark and have ridden an ostensible blue-chip ticker (with penny-stock behaviour atm) almost 10X to the upside in a quarter (it closed over ZAR180 at some point this week).

Possible 10X returns within a year without the stock ever approaching it’s all-time high is… pretty interesting. Yet, clearly there’s nothing to see here as the market regularly delivers jaw-dropping stories multiple times a day now.

E.g. The current market confidence appears purely based on (admittedly astounding & historic levels of) QE and a strong return in demand.

A slightly more pointed take

The fact that $10,000 invested in Hertz the day after it filed for bankruptcy was at some point this week worth over $125,000 notwithstanding - the Nikola midweek valuation takes the cake.

In short:

At $33 billion, Nikola's market cap is now higher than Ford's ($30 billion).

— Charlie Bilello (@charliebilello) June 9, 2020

Nikola has $0 revenue vs. $150 billion for Ford over the last year.$NKLA $F https://t.co/xRLp1VDzbi

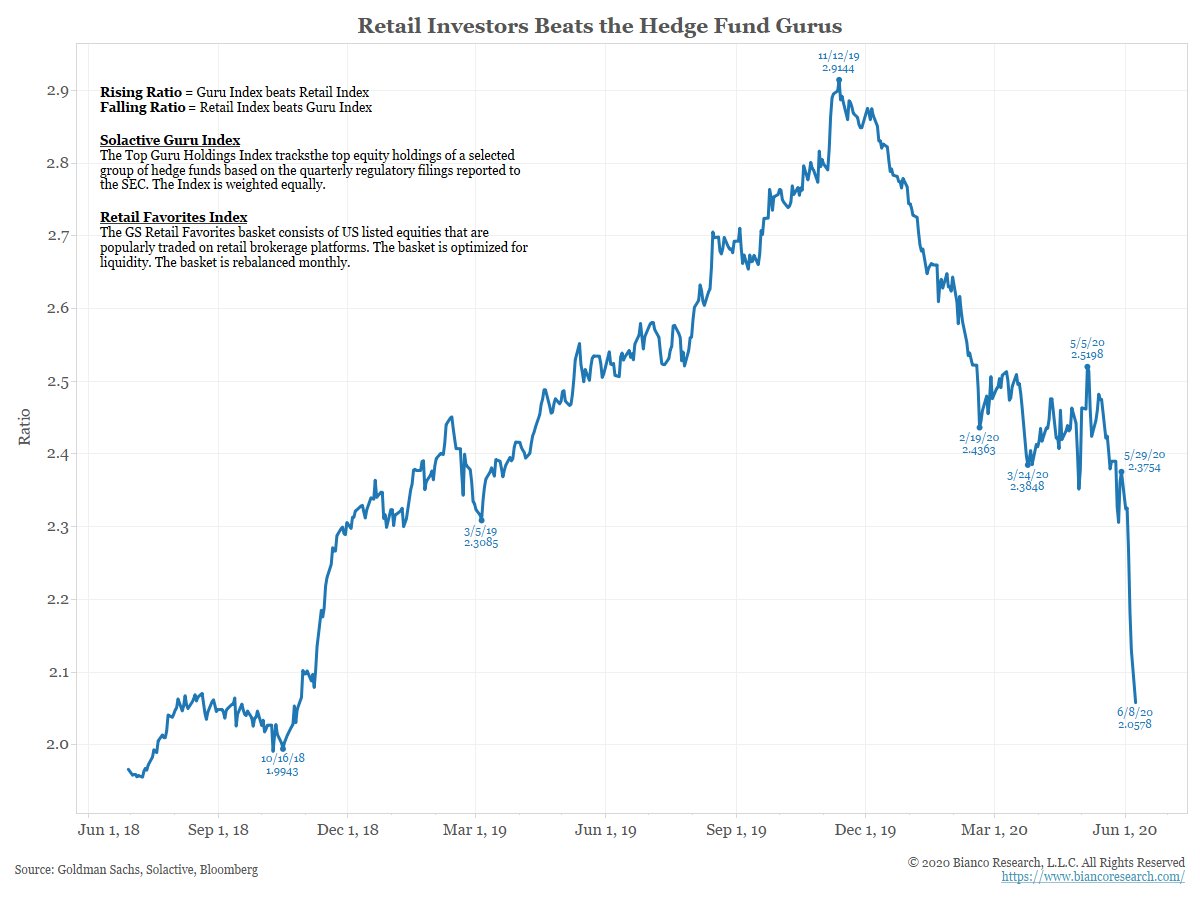

The weirdness of course means, at least over the last quarter, the “Robinhood” retail brigade rode the wave while billions of Warren Buffet & Carl Icahn shaped dollars sat on the sidelines.

🌌☀️💨🌏 Carrington Calling

Get ready to check off “Carrington” on your 2020 bingo card https://t.co/DyZZxUTGHm

— SwiftOnSecurity (@SwiftOnSecurity) June 8, 2020

As far as 2020 goes, we could definitely do with not ticking off Carrington Event 2.0 from the bingo card - as the year continues unfolding like a Black Mirror episode.

Kurzgezagt return to spooky titles in unpacking the mechanics behind these events.

🗽 Permanent Assumptions

I enjoy many of Morgan Housel’s blogs - hosted by Collaborative Fund where he is currently partner.

In this post he outlines what he calls 9 of his “permanent assumptions”, each of which he details with an additional few lines. I present the summary here:

- More people wake up every morning wanting to solve problems than wake up looking to cause harm.

- The world breaks about once a decade. There are so few exceptions it’s astounding.

- Stories are more powerful than statistics.

- Nothing too good or too bad stays that way forever.

- Knowing there will be a reversion to the mean does not mean you know when things will revert.

- Incentives are the strongest force in the world.

- A big group of people can get smarter and better informed over time. But they can’t, on average, become more patient, less greedy, or more level-headed during periods of upheaval.

- History is mostly the study of unprecedented events, ironically used as a map of the future.

- It’s easy to take advantage of people. It’s also easy to underestimate the power and influence of groups of people who have been taken advantage of for too long.

🦠🧼🖐💦⚕ Greenzone

Fantastic graphic taken from Clive Thompson’s article on WFH.

@jw’s thread pedantically outlining being triggered by it is also pretty good

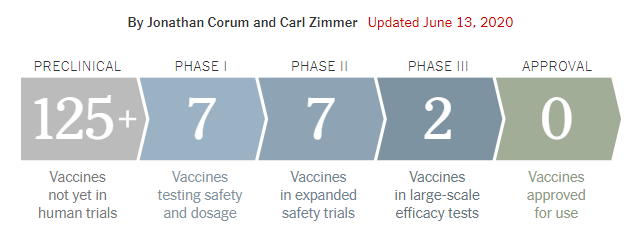

💉💊 Vaccine Search Update

Jonathan Corum and Carl Zimmer detail progress on current vaccine efforts on this oft-updated NYT page.

Seema Yasmin returns looking at three current vaccine approaches to covid19 and the people looking at them.

🎨 Summer in the city, Mason London, Digital, 2020

🧠💬 Keep Learning

“The juvenile sea squirt wanders through the sea searching for a suitable rock or hunk of coral to cling to and make its home for life. For this task, it has a rudimentary nervous system. When it finds its spot and takes root, it doesn’t need its brain anymore, so it eats it! It’s rather like getting tenure.” ― Daniel Dennett

🌴🌲✈️🌳🌴 Oh…and one more thing

You’re going to land where??

— World of Engineering (@engineers_feed) June 10, 2020

https://t.co/cAnrxojZ1K

📧 Get this weekly in your mailbox

Thanks for reading. Tune in next week. And please share with your network

Links The Week That Was Pickings

fa17eab @ 2023-09-18