💱🌎 Global Trade, Nature & Mechanical Principles

09 October 2022

Welcome back to the Week That Was series highlighting things from the interwebs which are interesting, noteworthy and/or probably worth your time.

Articles📝, Tweet(s)📱, Videos🎥, Charts 📈 all fair game with or without attendant commentary.

🎨 Burnout

Take care of yourselves as the year starts drawing to a close.

Burnout, Chiara Conti, digital, 2022

💱🌎 Global Trade

📚WEF published three interesting charts showing the current state of global trade.

These were from 📚DHL’s Trade Growth Atlas report whose key takeaways are as follows:

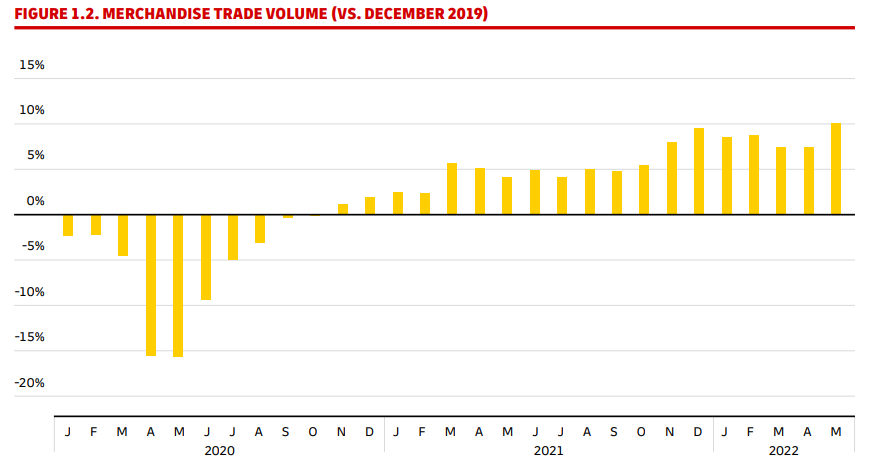

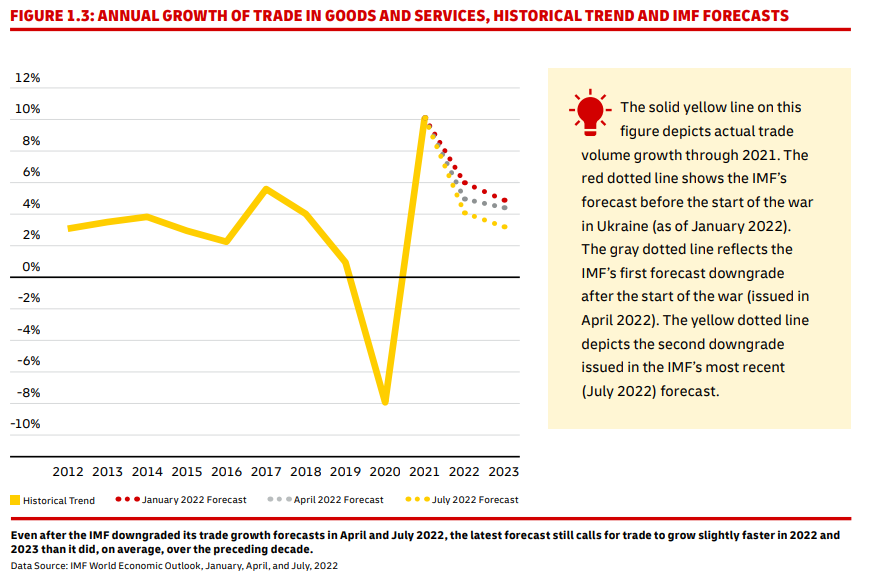

- Globalisation is not dead and global trade has been surprisingly resilient even through the C19 pandemic (“steepest decline in international trade on record - followed by the fastest recovery”)

- Trade likely grows faster in 2022/2023 than the past decade

- eCommerce boomed during the pandemic and cross-border growth remains

- Trade growth strengthens economics and can help lower inflation and boost economic expansion

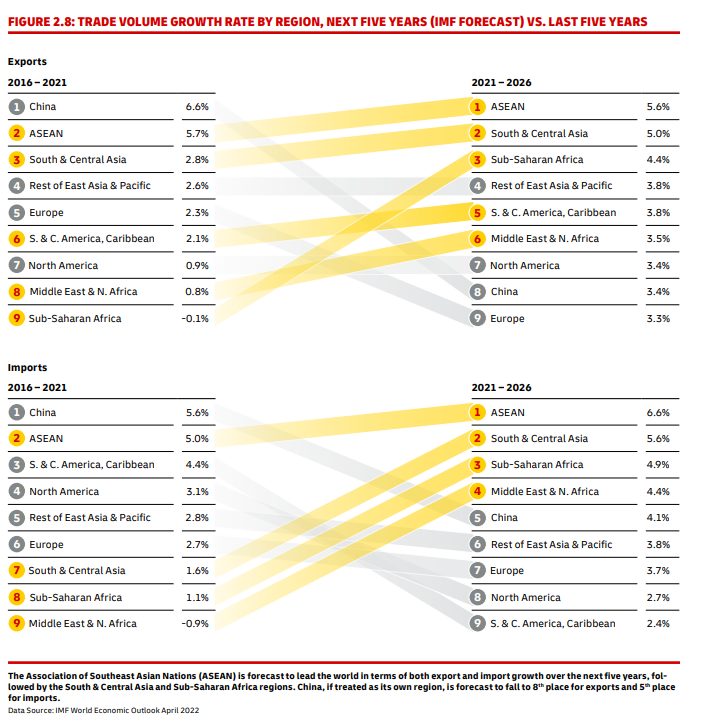

- Share of world trade from emerging economies grew from 24% to 40%

- Advanced economies will still have around 55% of trade growth through to 2026

- Trade growth is expanding across an even broader range of countries

- New poles are emerging as the world trade centre of gravity moves South

- Emerging markets have continued to export ever more sophisticated products, with the traded mix noticeably shifting

- Connectivity, innovation and leading companies will continue to race ahead in the emerging economies

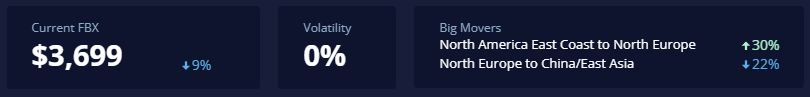

Incidentally as QE and other factors led to massive consumer spending spikes coupled with the supply chain and logistics issues - container prices on key routes from China to the US and Europe rose 100% from 2019 to 2020.

📈Said index has now collapsed 61% compared to September 2021, because demand is dropping as consumer spending decreases.

🔨 Maintenance

Rob Cottrell commenting on Alex Vuocolo’s longread called 📝“The Disappearing Art Of Maintenance”

A 21C inclination towards built-in obsolescence is creating a world that is hard to maintain. As a result, we are losing the art of good maintenance, which — although expensive — can head off the need for repairs later on. It’s a philosophy that could serve us well as climate change accelerates. “Repair is when you fix something that’s already broken. Maintenance is about making something last”

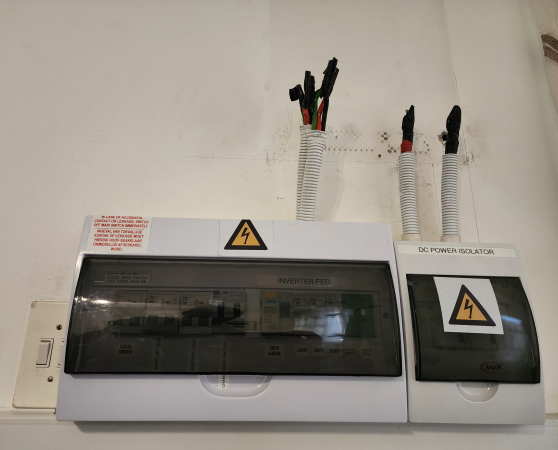

That last line is very close to the hearts of South Africans who continue to live under the spectre of intermittent blackouts and electrical grid as well as other major infrastructure instability - alot of it to do with lack of adequate maintenance (over and above deeper more strategic planning and implementation failures as well as inefficiency due to corruption).

It won’t be lost on the more avid reader of these pages that I haven’t published in roughly a month. A period of time which coincides exactly with the worst grid instability in a while - and strangely during a very warm spring period. A combination of our inverter motherboard blowing up, escalating loadshedding and finally a number of days of complete power failure due to all from substation dramas to cable damage meant the stack I use to write and publish has been largely incapacitated.

Eskom has given the populace some reprieve this weekend and coincidentally… I’ve returned (thank you for your patience!).

💾 Floppy

Per The Browser citing Niek Hilkmann & Thomas Walskaar on 📝The Floppy Disk Business:

Interview with one of the last people dealing in floppy disks. His wife persuaded him to buy “floppydisks۔com” in 1990 and he has never looked back. His business used to be mostly duplicating CDs and DVDs, but is now “90% selling blank floppy disks”. He carries “all the flavours” of floppy disk and his recycling service is now so popular that he sometime receives 1,000 disks a day in the post

🦾📹 Mechanical Principles

20 Mechanical Principles combined in a Useless Lego Machine

🏢💰 Dept of Moneys

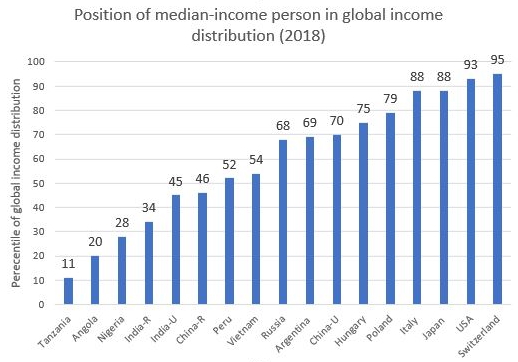

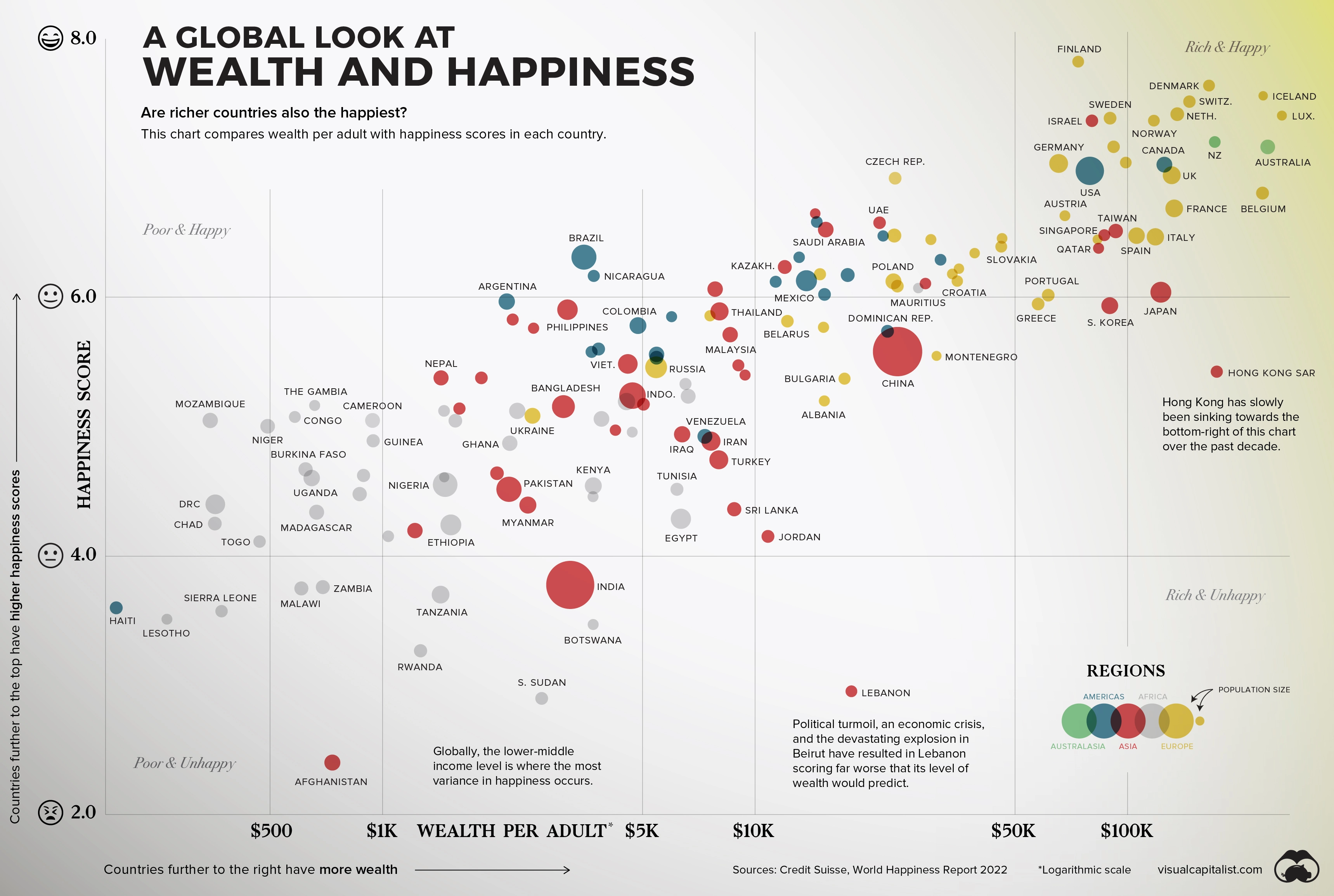

If you are a person w/median income in Tanzania, you are at the 11th global percentile (meaning that 89% of the people in the world are better off than you). But if you are a median-income person in Switzerland. you are at the 95th global percentile. (Adjusted for price levels)

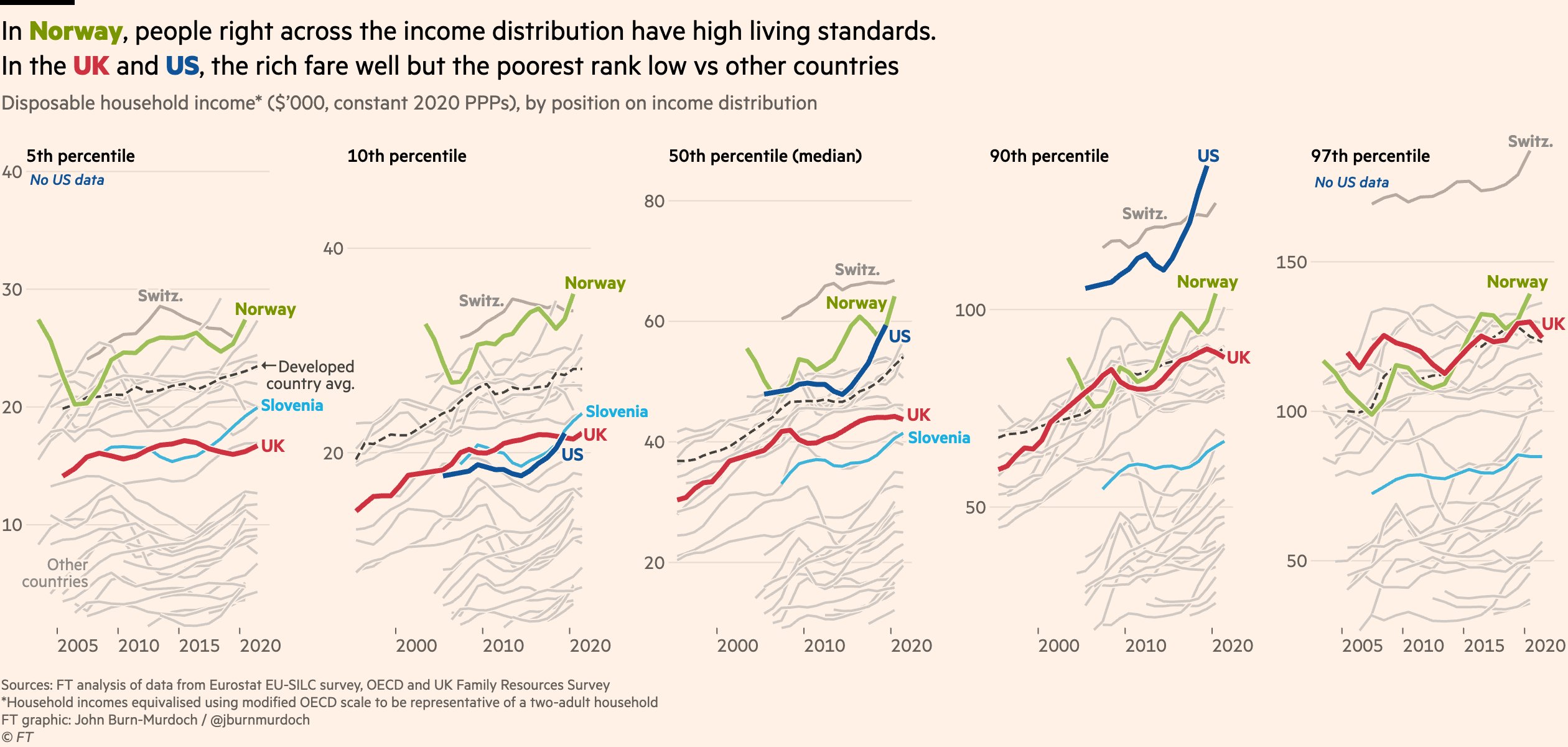

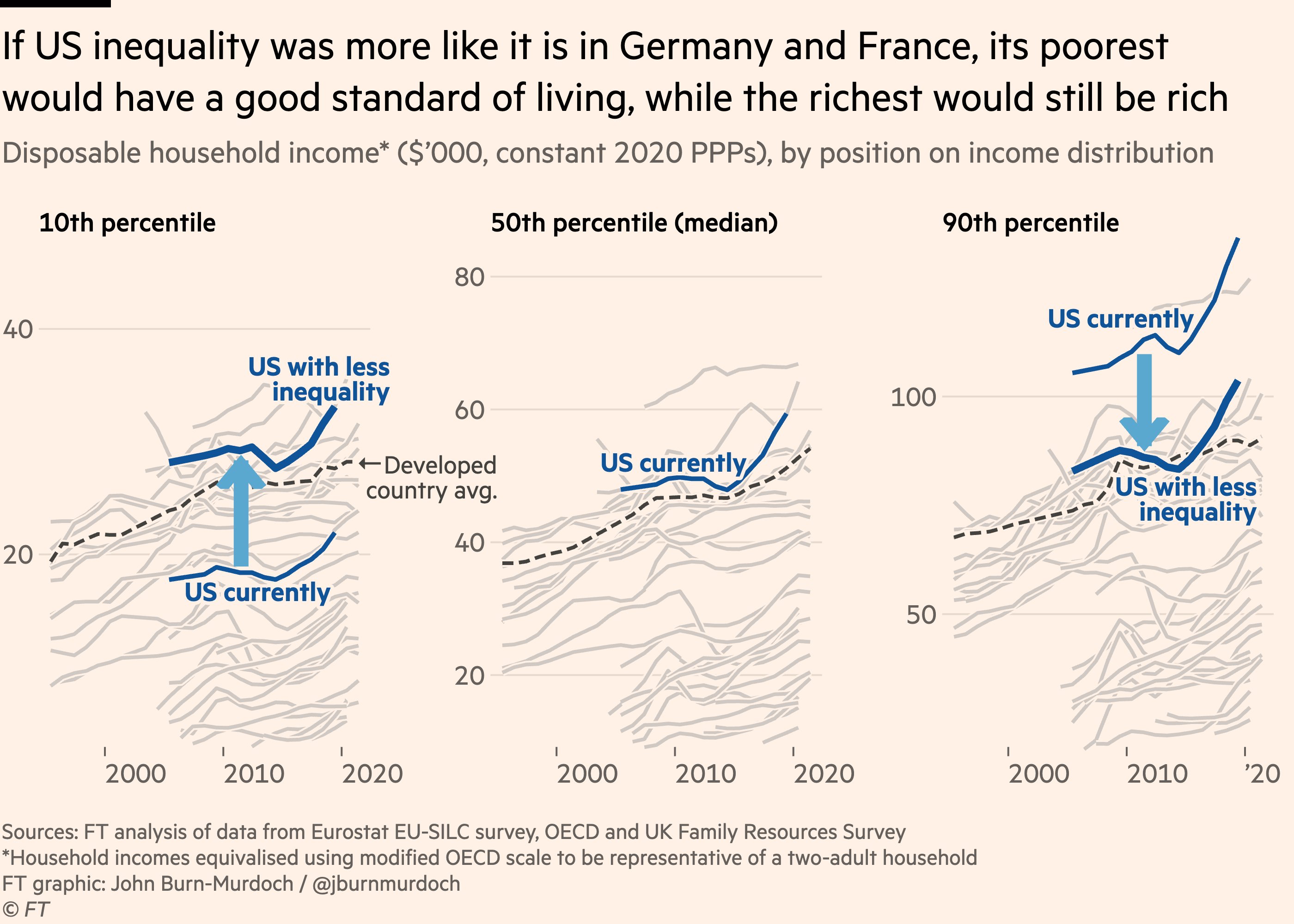

On the subject of inequality, interesting post a little while ago from 📰the FT where John Burn-Murdoch indicates:

Income inequality in US & UK is so wide that while the richest are very well off, the poorest have a worse standard of living than the poorest in countries like Slovenia

Essentially, US & UK are poor societies with some very rich people.

He unpacks it in this thread, which is worth a squizz (📰summarising the article).

In most developed countries, the distribution of income is ~relatively~ equal, with top 10% earning about 3x as much as bottom 10%.

— John Burn-Murdoch (@jburnmurdoch) September 16, 2022

That means the same *relative* standard of living broadly persists across the income distribution.

I believe US boomers control something like 1/7 of the whole world’s wealth…

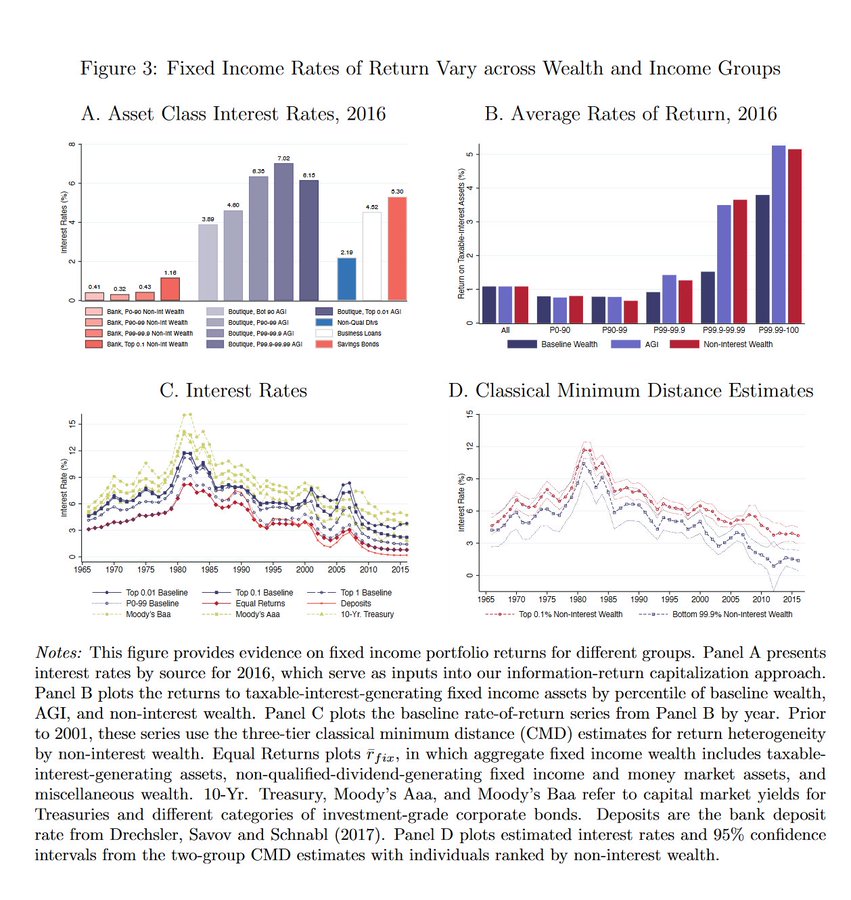

Ethan Mollick notes:

Adding to the inequality, the ultra-rich earn much more on their wealth than even the rest of the top 1%. For example, interest income for the top 1% in 2016 was 1%, for the top .01%, it was 3.8%. The ultra-rich have exclusive access to some investment opportunities & classes.

That relationship between wealth and happiness is definitely getting tested.

🎓💰

On the topic, Malcolm Gladwell takes a look at 📝Princeton’s Perpetual-Money Machine. Rob Cotrell notes:

Princeton University’s endowment now approaches $39 billion — the income from which should be enough for the university to educate all its students for free and still bank an unspent surplus of about $1 billion each year. Why doesn’t Princeton do just that? And why does Princeton go on raising money from alumni? “If you had a car that could run forever, would you still stop for gas?”

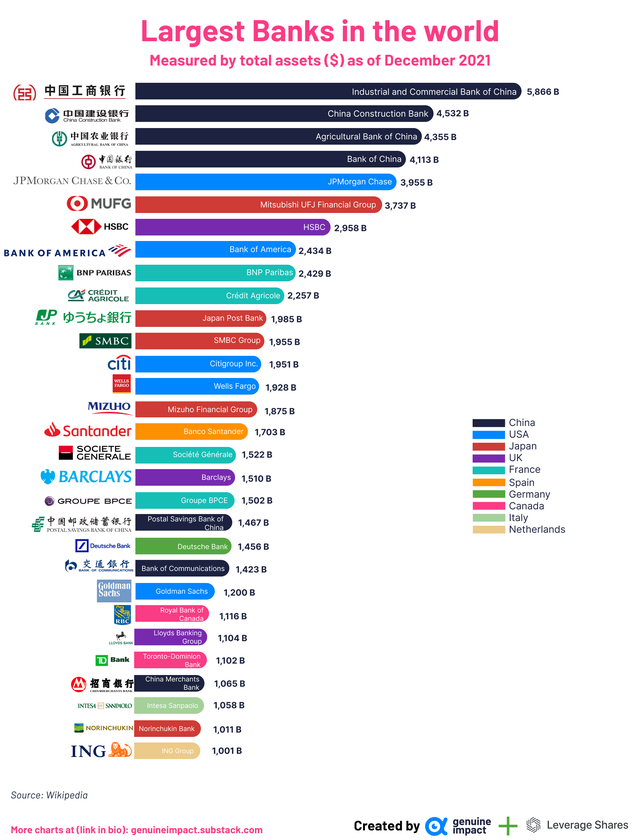

The biggest banking groups worldwide, through which alot of these machinations (and value) flow.

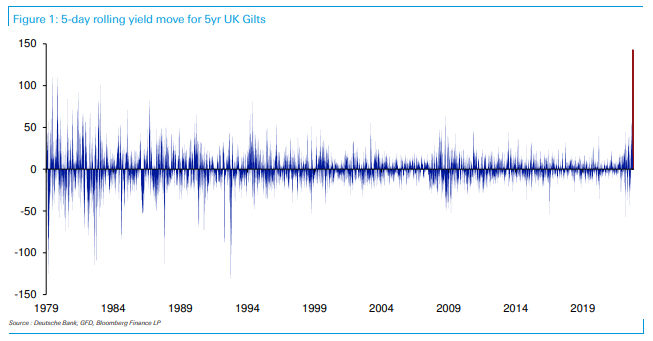

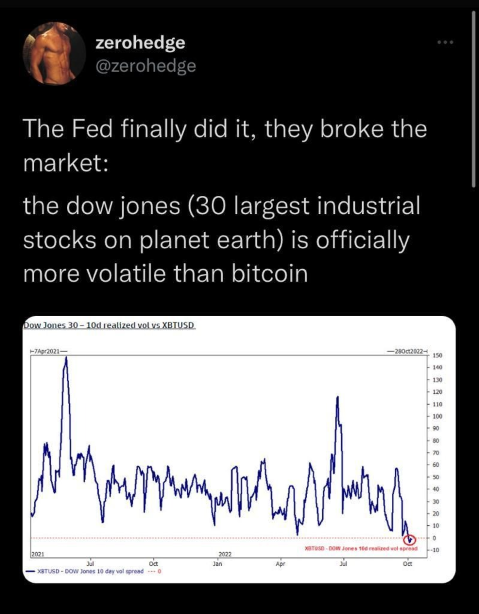

Meanwhile the markets continue to roil across asset classes. Richard Partington points out a Deutsche chart showing

UK 10yr borrowing costs have moved by the most in five days since 1976 when Britain applied to the IMF for a loan.

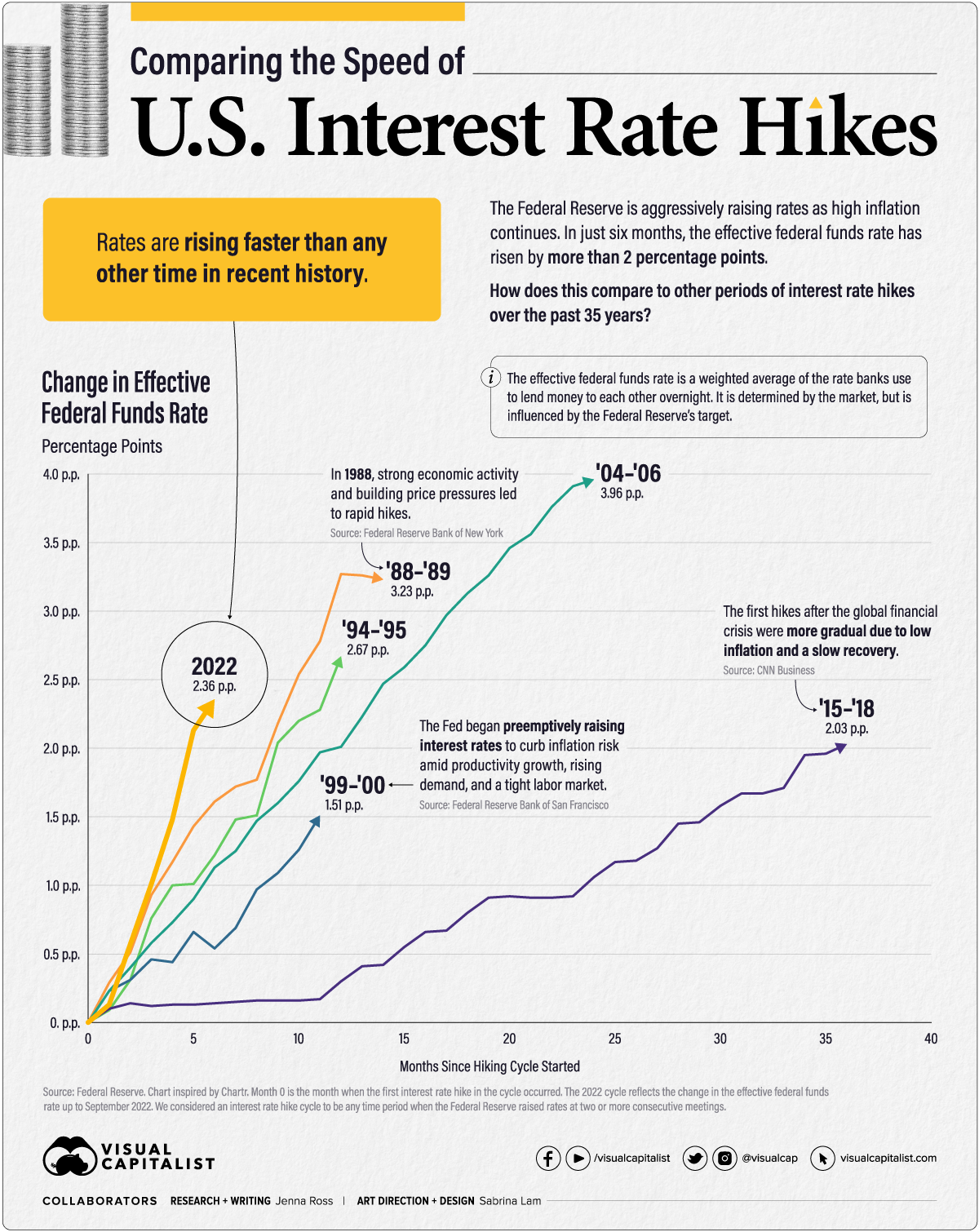

Mind you central banks across the globe are in an aggressive interest rate hike cycle responding both to inflation concerns and the hawkish actions of Jerome Powell and the FED - who are raising rates at breakneck pace.

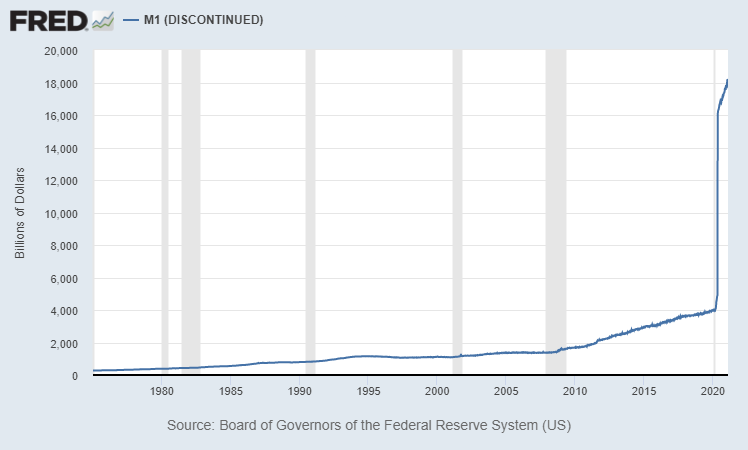

As stated, all of this tumult happening to try and break the back of inflation. Many argue this is a self-inflicted malady though e.g. looking at this M1 money supply graph from the US during the pandemic gives one pause.

Yet there’s still plenty of debate (and has been since the taps were fully opened) about what even is our current situation. Tim Harford was moved to weigh in - penning an article titled 📝“What We Get Wrong About Inflation”

In 1963 Milton Friedman defined inflation as “a steady and sustained rise in prices”, which was “always and everywhere a monetary phenomenon”. But Friedman’s rule hardly describes current conditions: Prices are rising because Russia has cut off Europe’s gas. Is this still “inflation”? Governments are confused. “The recently signed Inflation Reduction Act is no such thing”

Nevertheless, markets continue to puke in the face of the rise in discount rates. So much so Zero Hedge point out that the DJIA had a volatility print higher than Bitcoin recently 🤯

The USD’s current status as global reserve currency is part of the reason why other currencies are grossly underperforming it as they raise rates and why CBs globally are needing to respond tick by tick to the US’s action. Here’s how the global reserve ccy picture has evolved over time

One of the WallStreetBets degens, asked a text to image AI program it’s thoughts on financial markets this year. Hauntingly accurate.

🇪🇺⚡ European Energy

Per Foreign Policy:

Winter is coming, and Europe is facing an energy crisis that people are calling “generational.” Gas prices are now eight times what they were on average over the past 10 years and eight times more expensive than in the United States. On the show this week, Adam and Cameron discuss how bad it could get and why next year could be even worse.

The 16th century cold snap and subsequent immiseration came up in the discussion and the @Doomberg Twitter handle had a thread looking at that energy crisis and the one which looms over Europe today.

1/ In the second half of the 16th century, Britain plunged into an energy crisis. At the time, the primary source of energy driving the British economy was heat derived from the burning of wood, and Britain was literally running out of trees.

— Doomberg (@DoombergT) September 17, 2022

🐦📸 Dept. of Nature

Images taken from current and previous years’ Wildlife Photographer of the Year competition entries curated by the Natural History Museum.

These images were awarded for their artistic composition, technical innovation and truthful interpretation of the natural world.

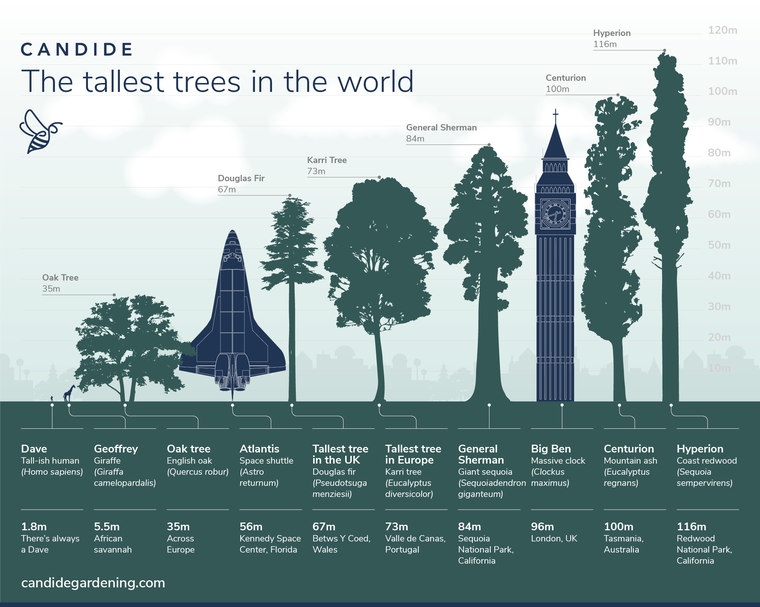

🌳🌲 Trees

📝An ode to the towering forest giants which constitute the world’s tallest trees

Some of the tallest trees on Earth can be found in the inaccessible tropics of Borneo and the ancient forests of Tasmania. Europe’s tallest trees are over 20 stories high but are all non-native species from wilder parts of the world. But none of these can match the stately grandeur and cathedral awe of the old-growth redwood and sequoia forests on the Californian coast - the ancient kings of the forest. These trees are genuine giants. The grandfather of them all, a magnificent coast redwood called Hyperion, stands a full 20m higher than London’s Big Ben or the Statue of Liberty in New York. It’s hard to grasp the true scale of these towering titans, but hopefully this infographic can help our tiny human minds comprehend the enormity of these trees.

It may come as a bit of a surprise to you but:

Worldwide tree cover has grown — not shrunk! It has grown by 2.24 million square kilometers — the size of Texas and Alaska combined — in the last 35 years

This per a 📚paper published in Nature by University of Maryland researchers by analysing satellite data to assess agricultural expansion, climate-driven expansion and contraction of ecosystems, and forest clearing and recovery.

🎨 Stargazer

Stargazer, Maldha Mohamed, Oil on wood, 2022

🎙️ Talent, Collapse, & Sex

Dwarkesh Patel talks to Tyler Cowen again with the discussion hinging on Cowen’s most recent book: Talent, How to Find Energizers, Creatives, and Winners Across the World.

They talk about:

- How sex is more pessimistic than he is

- Why he expects society to collapse permanently

- Why humility, stimulants, intelligence, & stimulants are overrated

- How he identifies talent, deceit, & ambition

Timestamps:

- (0:00) -Did Caplan Change On Education?

- (1:17) - Travel vs. History

- (3:10) - Do Institutions Become Left Wing Over Time?

- (6:02) - What Does Talent Correlate With?

- (13:00) - Humility, Mental Illness, Caffeine, and Suits

- (19:20) - How does Education affect Talent?

- (24:34) - Scouting Talent

- (33:39) - Money, Deceit, and Emergent Ventures

- (37:16) - Building Writing Stamina

- (39:41) - When Does Intelligence Start to Matter?

- (43:51) - Spotting Talent (Counter)signals

- (53:57) - Will Reading Cowen’s Book Help You Win Emergent Ventures?

- (1:04:18) - Existential risks and the Longterm

- (1:12:45) - Cultivating Young Talent

- (1:16:05) - The Lifespans of Public Intellectuals

- (1:19:42) - Risk Aversion in Academia

- (1:26:20) - Is Stagnation Inevitable?

- (1:31:33) - What are Podcasts for?

🎨 Star Gazer

Star Gazer, Luke, Acrylic, 2019

💬 Deep Cuts

“Logic is of use in proof, but almost never in invention” — Vilfredo Pareto

“Life is easy to chronicle, but bewildering to practice” ― E.M. Forster

“The wise have always said the same things, and the foolish have always done the opposite” — Arthur Schopenhauer

🎺🎶 One More Thing

Breathtaking performance by an ensemble of current and former jazz students at The Juilliard School. Most of the pieces are composed or arranged by the members, and they play with a quiet collective focus that is mesmerising. Special honour must be given to the audio engineers, too, who have managed to achieve a smoother, more balanced mix on a session captured in an open plan office than can be found on most studio recordings.

📧 Get this periodically in your mailbox

Thanks for reading. Tune in again. And please share with your network.

Links The Week That Was Pickings

fa17eab @ 2023-09-18