(This Week) Ergodicity, Wimbledon & Cognitive Biases

19 April 2020

Welcome back to the Week That Was series where I highlight a few things from the interwebs which I thought were interesting, noteworthy and probably worth your time. Articles📝, Tweet(s)📱, Videos🎥, Charts 📈 all fair game with or without attendant commentary.

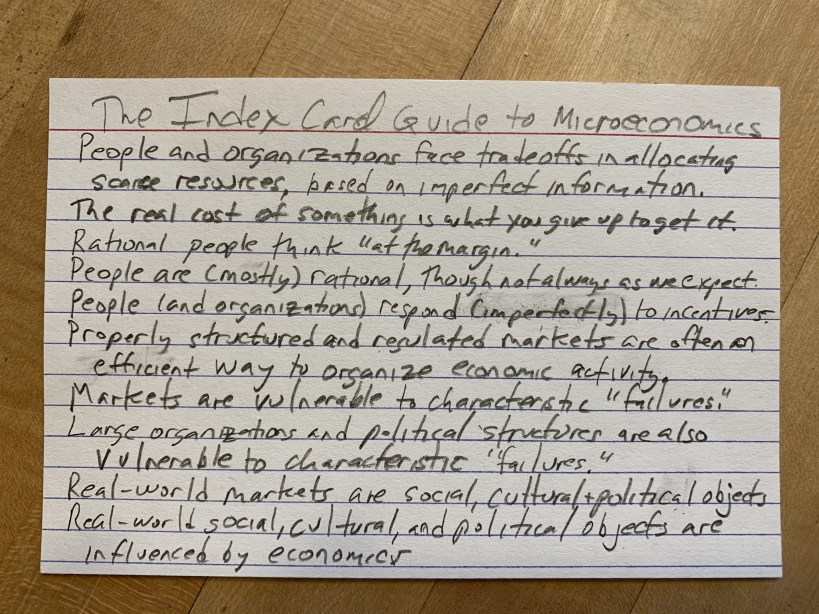

✏️📈 Microecos Index Card

Credit: @darrenrovell

🎾💰 Wimbledon Cashes In

Wimbledon reportedly paid $2 million a year for pandemic insurance for the last 17 years

— Darren Rovell (@darrenrovell) April 8, 2020

(Total: $34 Million)

For this year's cancellation as a result of the Coronavirus, Wimbledon will reportedly receive $141 million from the policy.

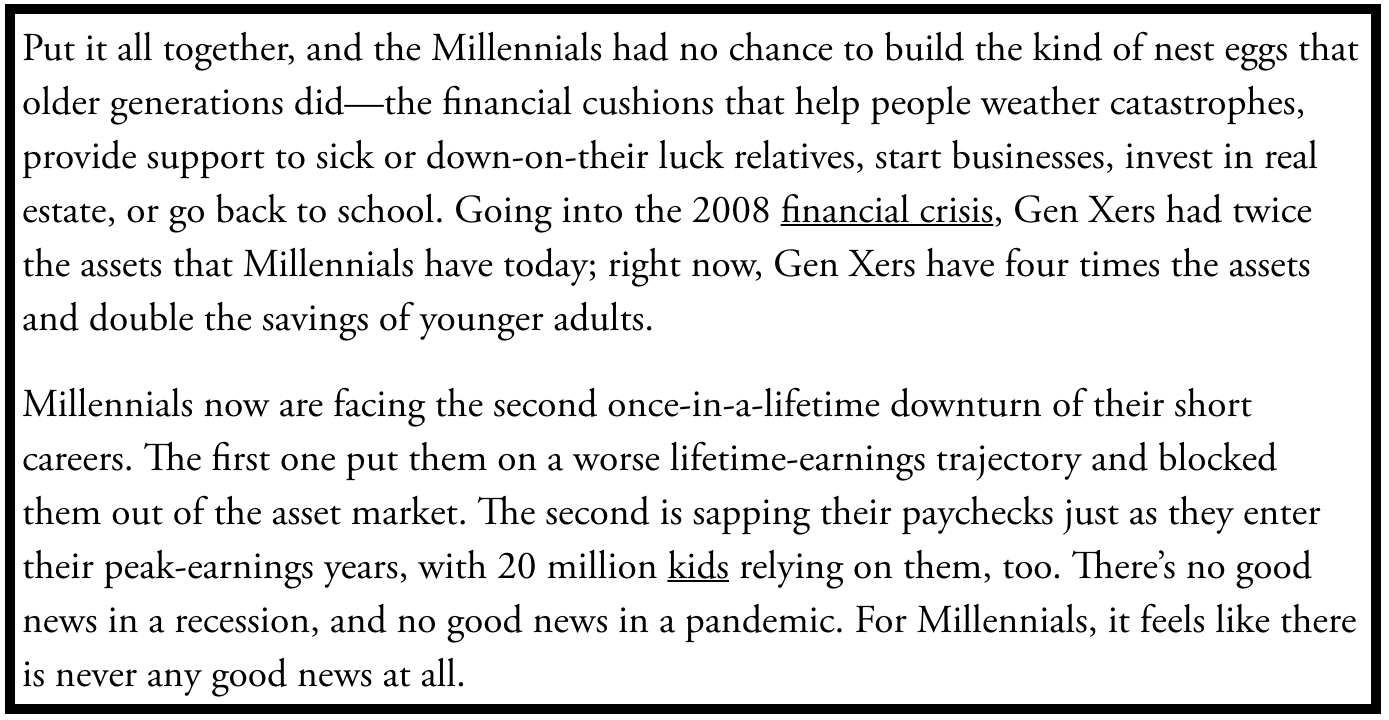

⬇️💸😩 Once In A Lifetime…again

Millenials are now potentially 2 for 3 in terms of worst downturns in history, having now experienced this so-called “once in a lifetime” events twice.

The Atlantic unpacks just how historical forces beyong their control will have lifelong effects.

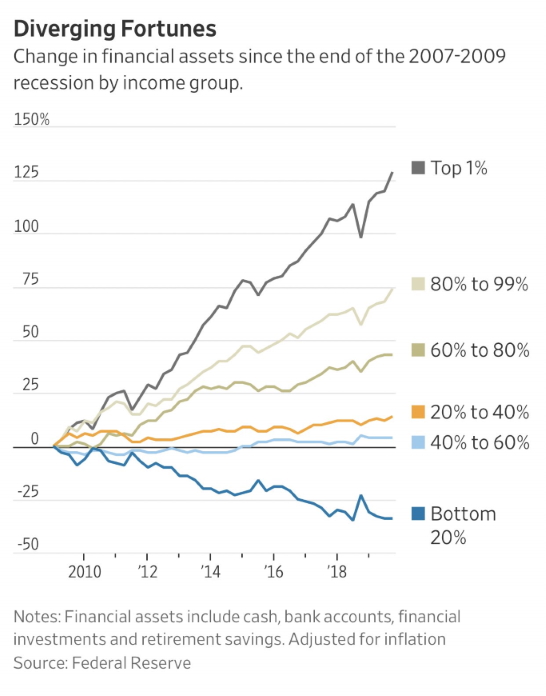

This cohort has also been bearing close witness to another social phenomenon which is exacerbating growing feelings of discontent and often anger.

🕊️ RIP John Conway

John Horton Conway was once referred to as “a cross between Archimedes, Mick Jagger and Salvador Dalí.”

What is certain is that his contribution to our understanding of complexity and how it can arise from deceptively simple rules was immense. Sadly on 11 April 2020, he passed on due to COVID-19 related complications.

Special thanks to XKCD for the graphic tribute.

🔎📏📉 Analysing Selloffs

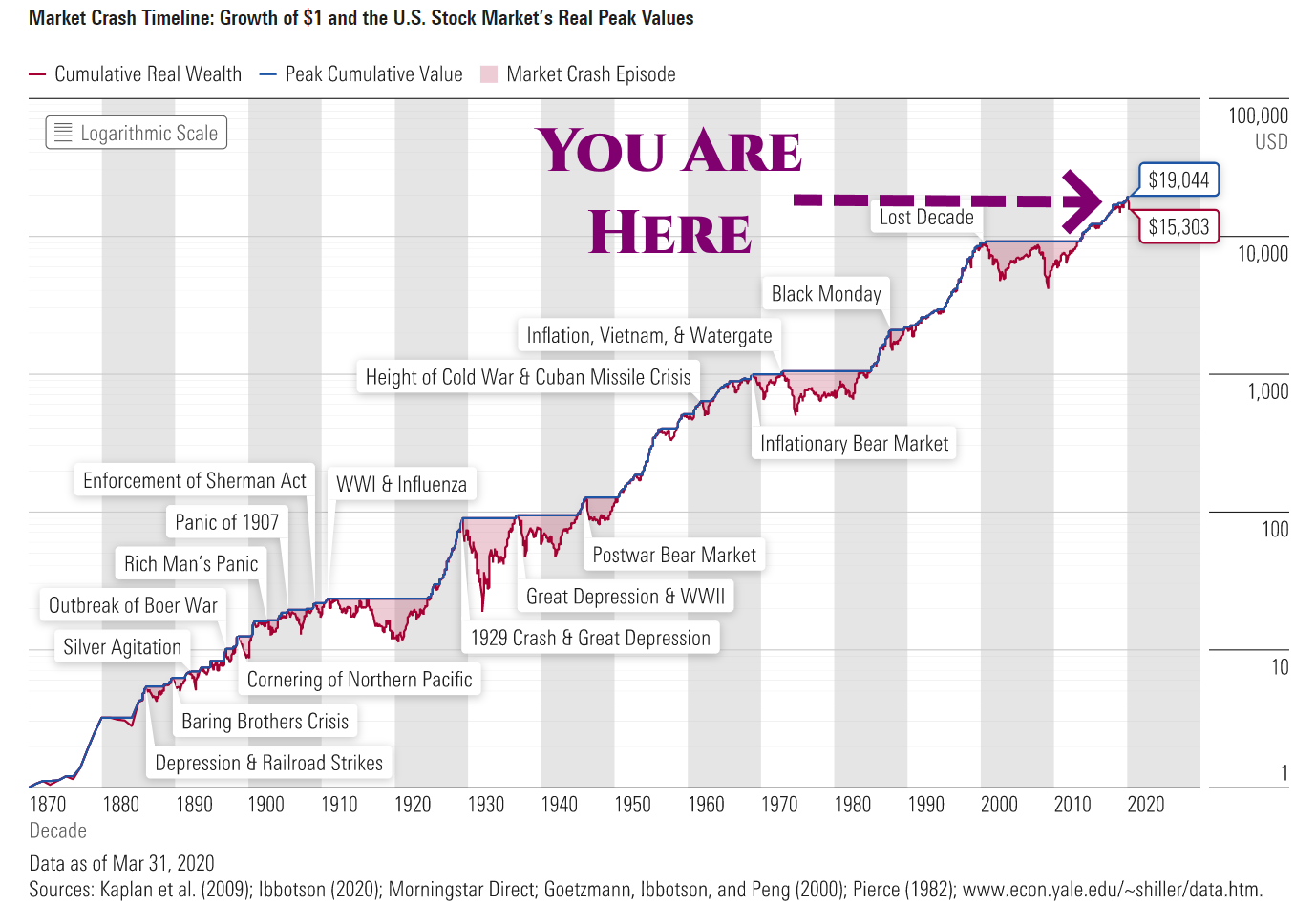

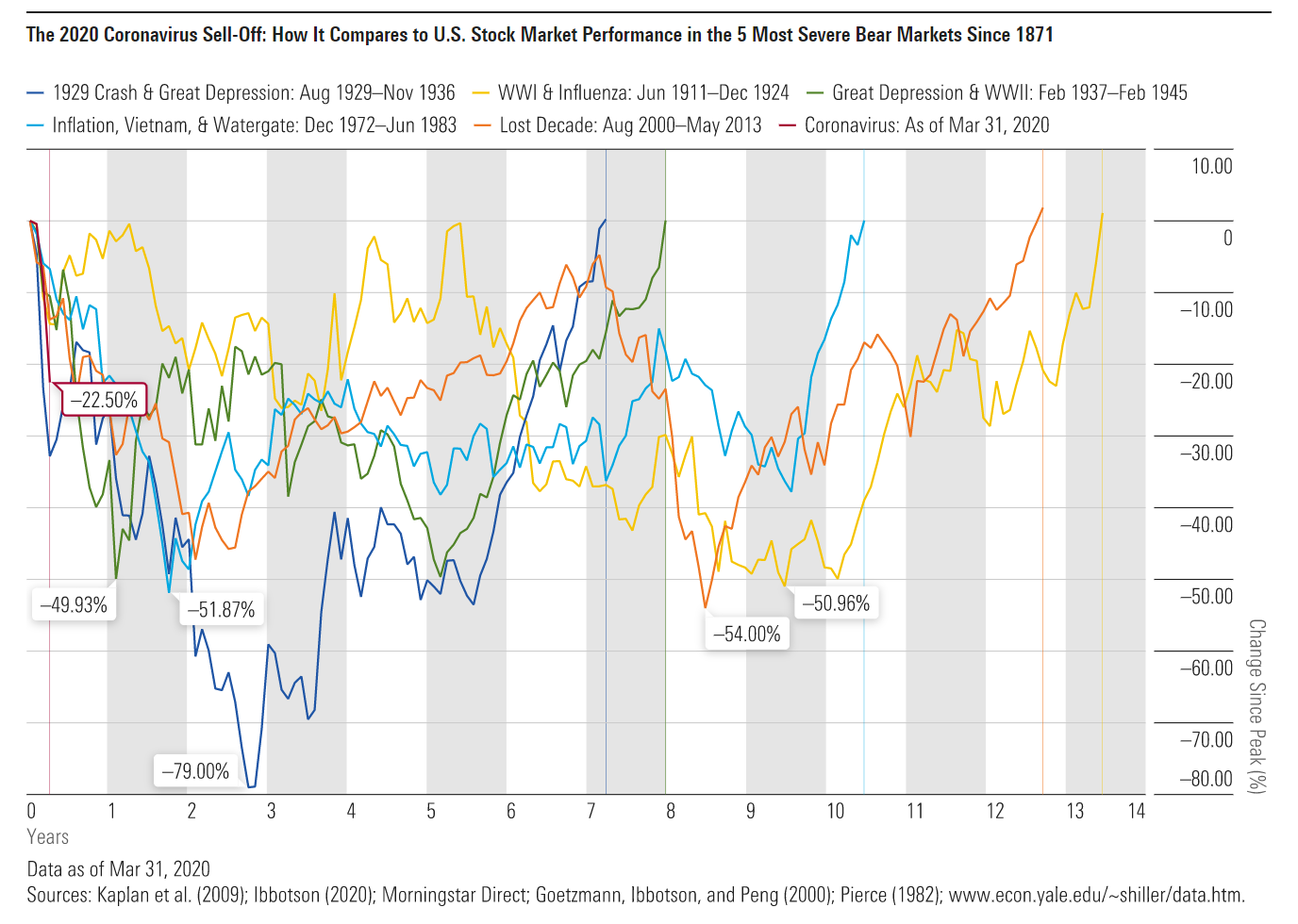

Paul D. Kaplan (Ph.D, CFA) the current Morningstar Canada director of research, put together quite an interesting analysis comparing the current US markets (a proxy for global markets given it’s size and relative importance) downturn with the 20th and 21st century’s worst.

Some notes from his research:

- The 79% loss due to the crash of 1929, which led to the Great Depression, is the worst drop on the chart.

- The 54% drop from August 2000 to February 2009, also known as the Lost Decade. The second-worst drop on the chart, this period started when the dot-com bubble burst. The market began recovering but not enough to get the cumulative value back to its August 2000 level before the crash of 2007-09. It didn’t reach that level until May 2013—almost 12 and a half years after the initial crash.

- The 51% drop between June 1911 and December 1920. This market downturn, the fourth-worst on the chart, may be most relevant to today’s situation, since it included the influenza pandemic of 1918.

It’s early and uncertain days, even though the above graph has quite a steep drop. Although we’ve already seen a Jerome Powell QE-inspired 25% recovery from the lows - with some commentators suggesting they’ve priced in the worst - continued optimism in the short/medium term would be….surprising.

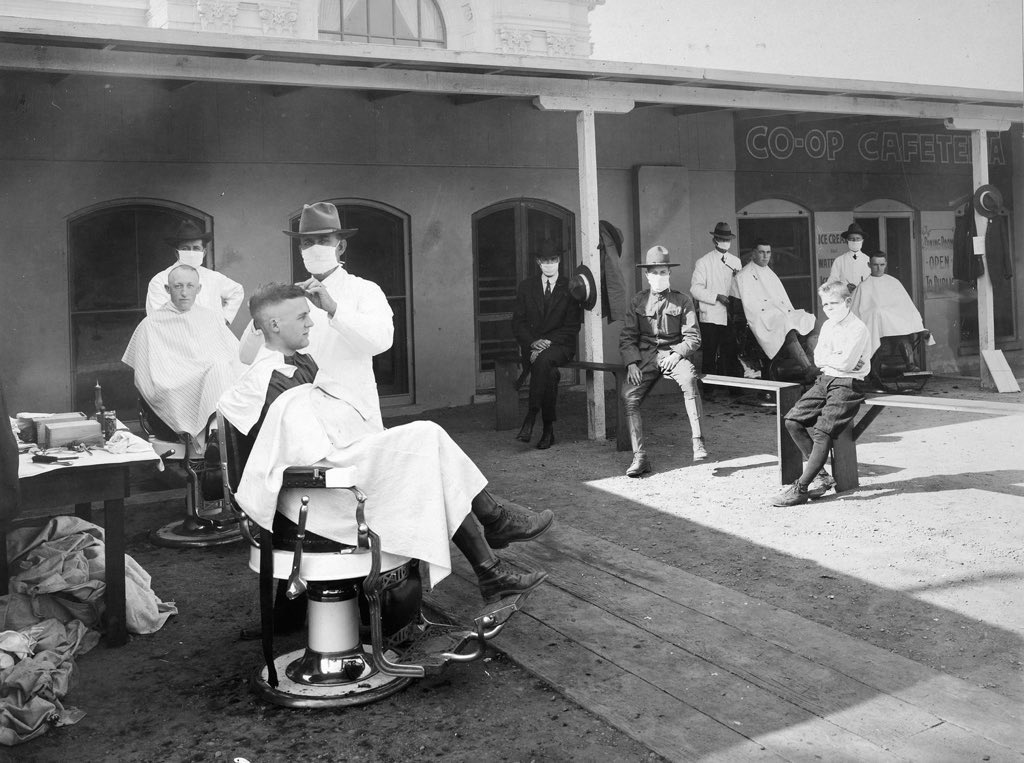

🦠🧼🖐💦⚕ Greenzone

That 1918 Spanish Flu social distancing cut.

Credit: @ianbremmer

SlatStarCodex

Intriguing take about exactly how accurate our predictions can actually be from the initimatable Scott Alexander aka @SlateStarCodex

Prediction is very hard. Nate Silver is maybe the best political predicter alive, and he estimated a 29% chance of Trump winning just before Trump won. Berkeley professor Philip Tetlock has spent most of his life identifying the best predictors in the world and coming up with complicated algorithms for aggregating their predictions, developing a forecasting infrastructure that beats top CIA analysts, but his superforecasters estimated a 23% chance Britain would choose Brexit just before they did. This isn’t intended to criticize Silver or Tetlock. I believe they’re operating at close to optimum – the best anyone could possibly do with the information that they had. But the world is full of noise, and tiny chance events can have outsized effects, and there are only so many polls you can scrutinize, and even geniuses can only do so well.

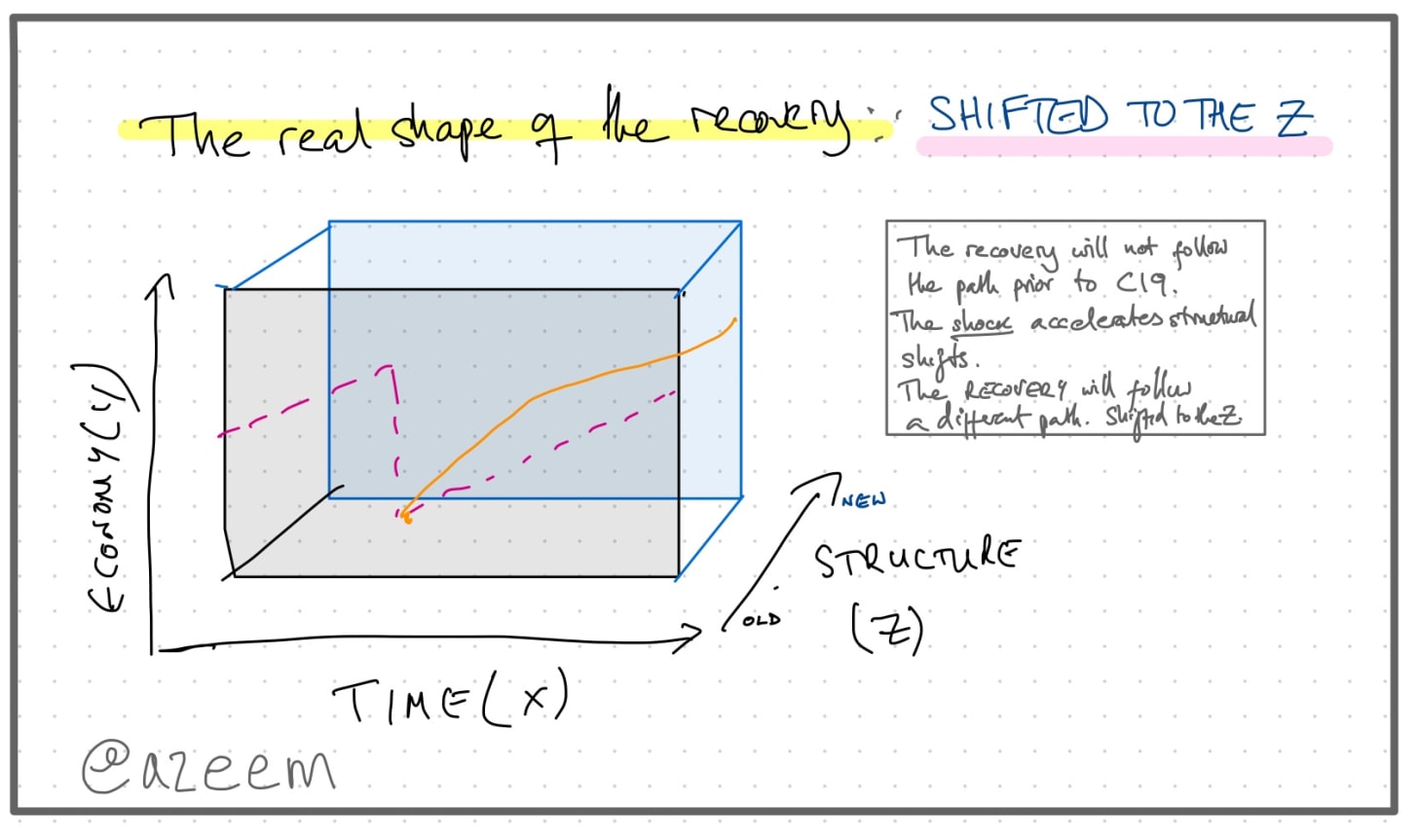

Azeem Azhar with an interesting post that’s now been made freely available about the fact that most recovery graphs are missing the Z-axis for structural changes.

To quote @TaylorPearsonMe: “Will the economy bounce back? Yes. But, the recover won’t happen on the same path as the decline. The economy is non-ergodic!”

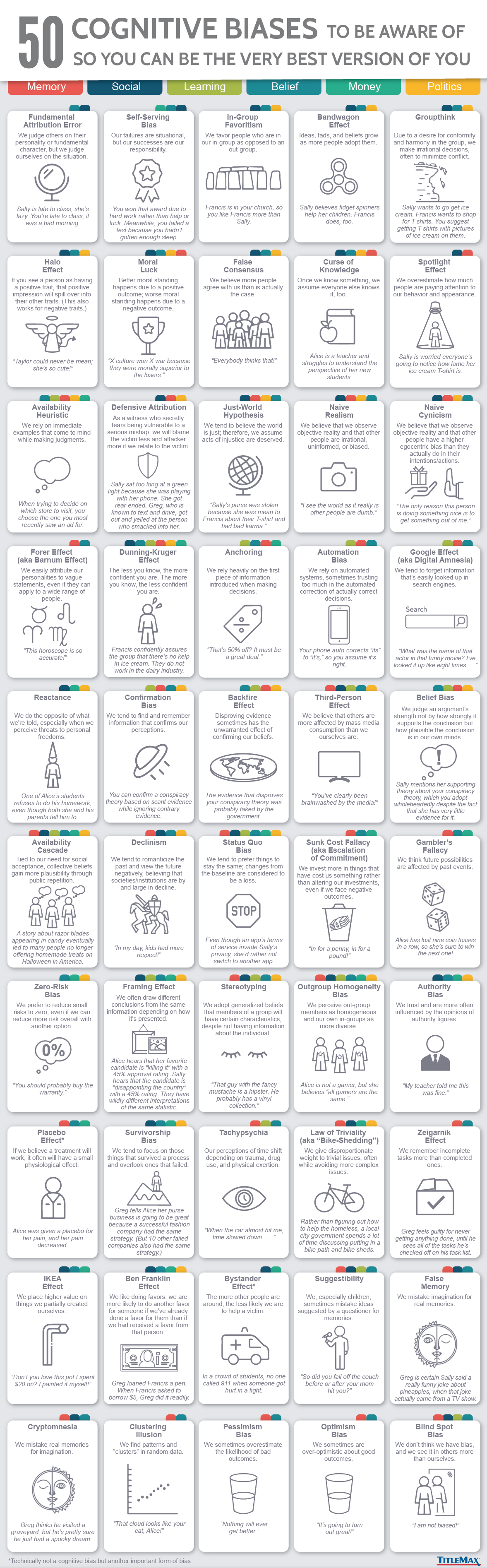

🧠 Cognitive Biases

A selection of some of the most popular malware known to infect Brain.exe

Credit: Visual Capitalist

💬 Action

“Take actions such that you would be glad to receive the news that you had taken them” — Eliezer Yudkowsky

📽️ Oh…and one more thing

Good to see both Shane and Suroosh (Vice co-founders) getting back into the fray with videos being released quite close to each other.

Here Suroosh documents his travels to Iran where he hobnobs with quite the motley crew just before the the US took out the country’s 2nd most powerful person early this year.

Thanks for reading. Tune in next week. Stay indoors. Keep in touch with your loved ones

Links The Week That Was Pickings

fa17eab @ 2023-09-18