(This Week) Hong Kong, Flash Loans & 2 Hour Chairs

19 February 2020

Welcome back to the Week That Was series where I highlight a few things from the interwebs which I thought were interesting, noteworthy and probably worth your time. Usually a couple of links spanning an article📝, tweet(s)📱, video🎥, graphs 📈 and/or any other media with some commentary, summaries or callouts for context.

Might be from 2020 or 1920 BCE - so long as it’s useful/interesting/insightful.

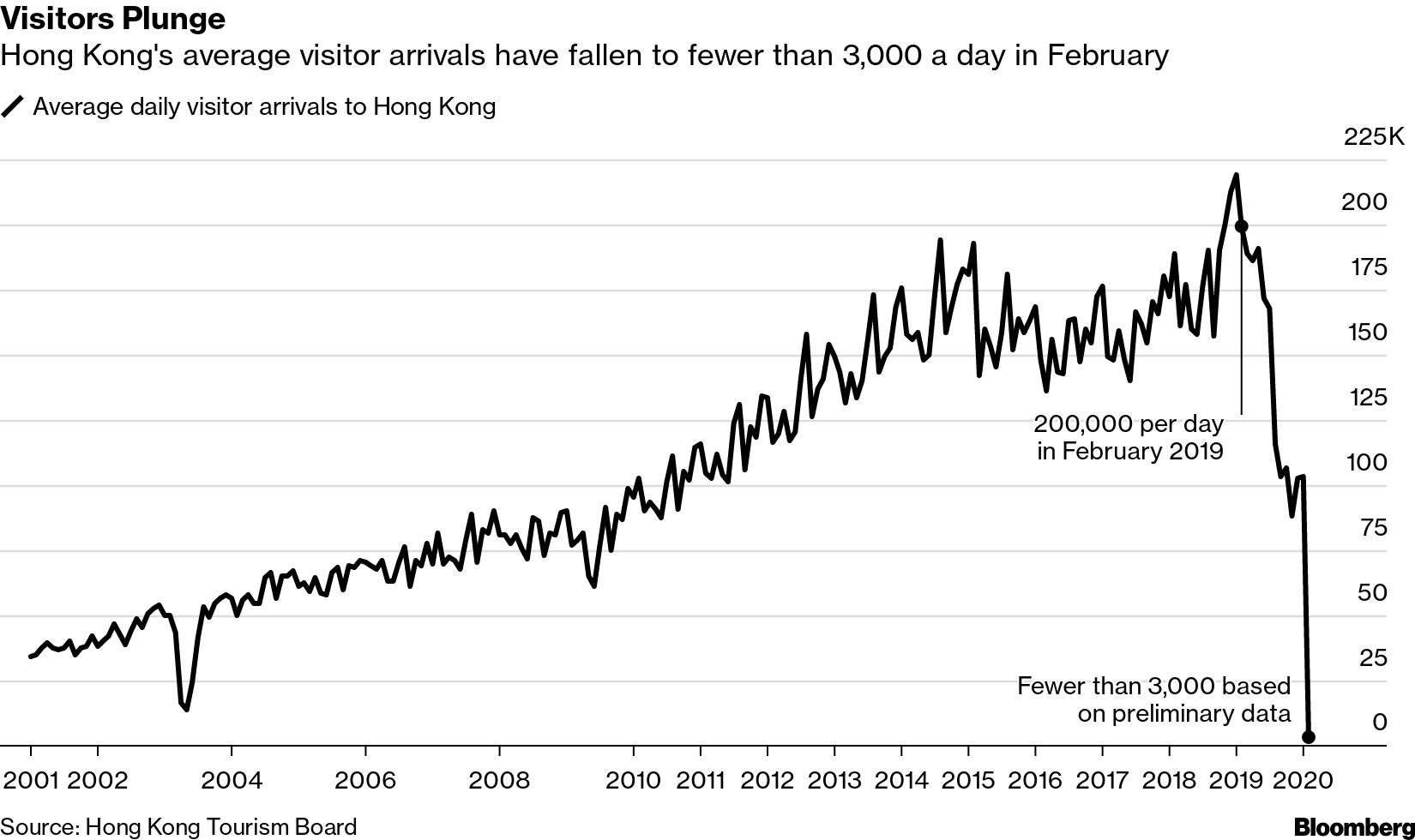

✈️ Hong Kong Travel Collapse

Having suffered a decline in tourist visits throughout 2019 due to the ongoing protests and civil unrest, Hong Kong finds itself with a massive drop in inbound traffic as a consequence of the COVID-19 coronavirus outbreak. This chart whose data was released by the HK Tourism Board, shows the average daily visitor arrivals and what can only be described as the devastation the outbreak has caused them.

Chinese trippers tend to dominate Asian travel and the severe movement restrictions are already starting to wreak havoc on tourism all across the region.

I haven’t seen a graph with such a sharp fall since crypto winter 2018!

🏦💰 Flash Loans: How to make $350,000 USD in 15 seconds

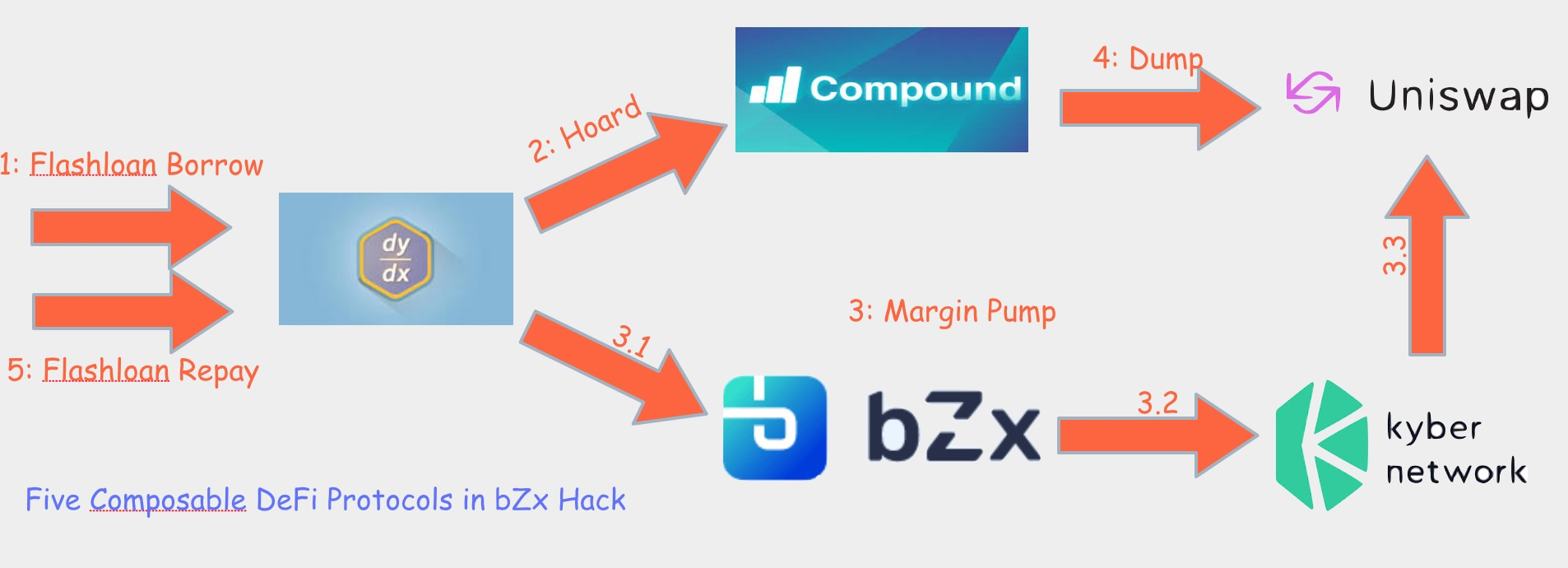

On the 15th of February 2020, a complex series of transactions was conducted via various so-called Decentralised Finance (known as DeFi) platforms which functioned as both an exploit and sophisticated arbitrage trade involving smart contracts and a flash loan.

There were several steps in what was originally (perhaps mistakenly) characterised as a hack, all outlined in this fantastic post-mortem of the most interesting exploit I’ve read about in a while.

tl;dr - Perp steals $350k in 5 “easy” steps

- Borrows 10,000 Ethereum (ETH) tokens on dYdX platform (uncollaterised!!)

- Deposits 5500 ETH on Compound as collateral to borrow 112 WBTC (Basically a 1:1 BTC backed token which is available on the Ethereum network)

- Manipulates price of WBTC upwards on the exchange he is planning to unload on by doing massive margin trading to short ETH in favour of WBTC

- Dumps the 112 WBTC on Uniswap

- Repays the original 10,000 ETH and has earned approximately 1,271 ETH or $355,880 (1,271 x $280) through his activities

Incredibly, this was all automated, having been executed via a smart contract which effectively executed all of it’s steps as a single atomic unit of work and within 15 seconds, the perp was a third of the way to a million USD richer.

Mortal blow to DeFi? Unlikely, particularly with ETH bulls saying it’s probably a good thing that this sort of thing is happening while the market caps going through these platforms are relatively low. This has however given BTC maximalists much reason to chuckle softly (or indeed loudly) as yet another set of Ethereum projects are exploited for massive gain.

Breathtaking visualization of today’s @bzxHQ attack courtesy of @bneiluj

— Spencer Noon 🕛✨ (@spencernoon) February 15, 2020

The crazy part:

This all happened in a single transaction with a fee of $8.28 🤯 pic.twitter.com/2efjVu7Ivu

(Geek Corner: The actual transactions enumerated & visualised via Bloxy)

💬 Freedom

Ubi dubium, ibi libertas

“Where there is doubt, there is freedom”

🎧 The Trouble With Table 101

Interesting podcast from NPR Planet Money looking at a quick case study in the restaurant game and testing whether “more seats, more money” actually leads to results. Restaurant design expert Stephani Robson is brought into casual Indian spot Adda in New York’s Long Island City, to help rethink how a customer behaves at a table, and how small changes can lead to a lot more money.

A data-driven restaurant makeover

https://overcast.fm/+HuIieJiNY

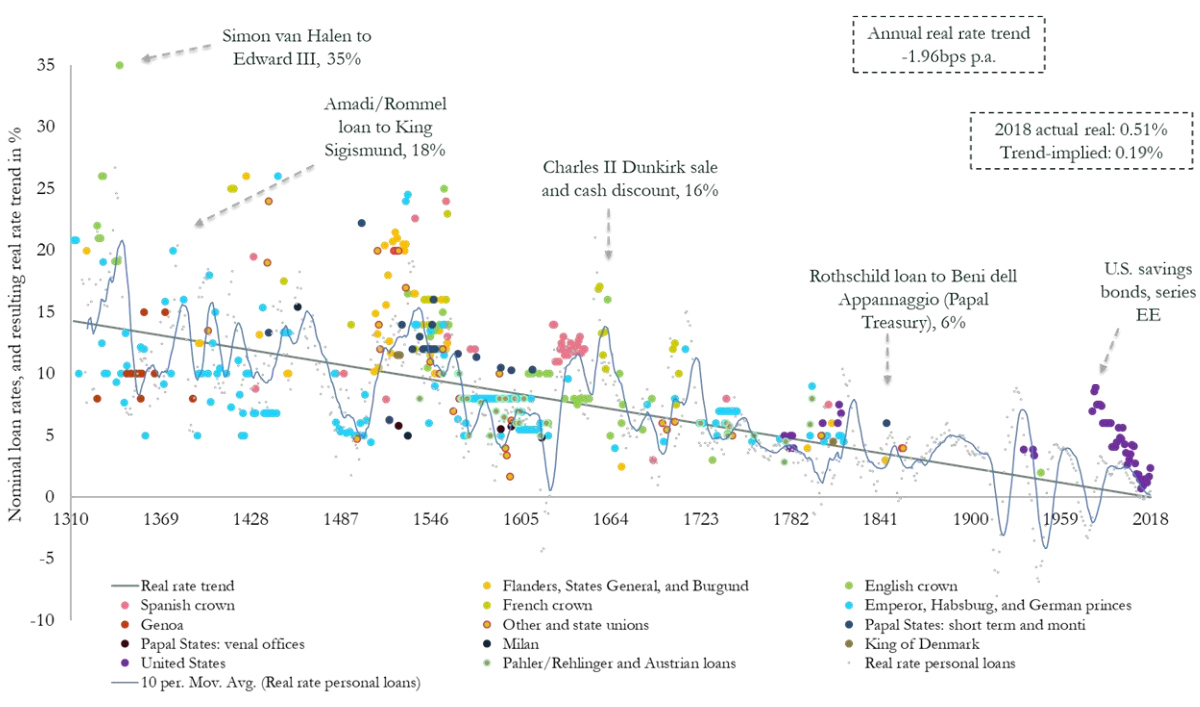

📝 700 Year Fall of Interest Rates

Now that large swathes of the Western world are experiencing historically low (or even negative!) interest rates on, Paul Schmelzing - visiting scholar at the Bank of England (BoE) presents a graphic showing the average interest rate decline throughout the last eight centuries.

Original Visual Capitalist Article Here

📹 Post Truth & Dr. Georgio Yakatura

Youtuber Jreg gives his take on post-truth, as the culmination of his Master’s thesis written in memory of Dr. Georgio Yakatura. Worth watching ’til the end.

What I will say is I’m a fan of meta-media and multiple levels of irony. Jreg’s entire channel is a study in meta and irony.

🌊🤿 Oh…and one more thing

We spend ALOT of time scrolling on our phones. Take a couple of minutes to scroll through this informative deep dive from the surface to the bottom of the ocean

Thanks for reading. Tune in next week

Links The Week That Was Pickings

fa17eab @ 2023-09-18